Comrade To Huy Vu, Party Secretary, Chairman of the Board of Members of Agribank spoke at the 113th Conference of the Standing Committee of the Agribank Party Committee, term 2020 - 2025

Recently, the Government leader, Head of Steering Group No. 4 of the Government Party Committee chaired a meeting and gave opinions on the preparations for the Party Congress of the Party Committee of the Bank for Agriculture and Rural Development of Vietnam (Agribank). Comrade To Huy Vu, Party Committee Secretary, Chairman of the Board of Members of Agribank, had an interview with the Government Electronic Newspaper on the implementation, acceleration of digital transformation, improving governance, and promoting the key role of "Tam Nong".

Agribank promotes application of Basel III standards in risk management

Could you please tell us what solutions the Agribank Party Committee has and is taking to soon realize the direction of the Government leaders on applying advanced banking standards in the field of risk management and Basel III standards?

Party Secretary, Chairman of the Board of Members of Agribank To Huy Vu: The Agribank Party Committee is directly under the Government Party Committee, consisting of 211 branches and affiliated Party Committees with more than 24,500 Party members. During the 2020-2025 term, the Agibank Party Committee has synchronously deployed Party building work, led the entire system to complete the targets of the Resolution of the 10th Agribank Party Congress and successfully organized Party Congresses at all levels, preparing for the 11th Agribank Party Congress.

Agribank continues to play the role of a leading and dominant financial institution in the agricultural and rural financial market. The Party Committee has directed the promotion of risk management, digital transformation, transparent and efficient operations. At the same time, Agribank has gradually improved and applied advanced risk management models, aiming towards Basel III standards.

By 2025, Agribank will have complied with Basel II according to Circular No. 13/2018/TT-NHNN and 41/2016/TT-NHNN of the State Bank of Vietnam (SBV). The risk management system including 3 lines of protection has been completed; operational safety ratios always meet the requirements of the SBV. Agribank is rated Ba2 by Moody's, BB+ (stable outlook) by Fitch Ratings, equivalent to the national credit rating. This is the foundation for Agribank to move towards Basel III.

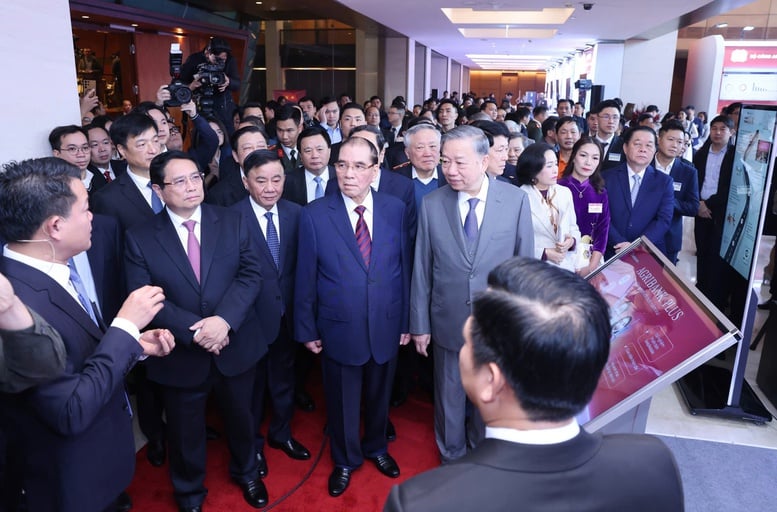

General Secretary To Lam and Party and State leaders visited Agribank's digital technology product display area within the framework of the National Conference on Breakthroughs in Science, Technology, Innovation and National Digital Transformation.

In order to realize the goal of applying advanced Basel III standards, the Party Committee of Agribank has directed the synchronous implementation of tasks and solutions in the field of risk management and Basel III standards, focusing on key solutions.

Firstly, continuously review and improve the system of policies and organizational models, internal procedures on capital adequacy assessment (ICAAP) and risk management processes. Focus on reviewing, adjusting and supplementing internal regulations on risk management in all aspects of operations, ensuring compliance with new legal documents and appropriateness to Agribank's operating situation in each period.

Second, build a roadmap for implementing Basel II using an advanced approach and prepare conditions for applying Basel III as early as 2025. This includes an investment plan to upgrade technology systems and databases to meet the more complex risk measurement requirements in Basel III standards; combine hiring consultants and learning from international experience to implement new Basel III standards...

Third, actively strengthen financial capacity and equity, proactively propose solutions to competent authorities to increase charter capital. Increasing charter capital will help Agribank meet the increasingly high capital safety ratio according to Basel III standards, while expanding credit growth space to serve economic development. To strengthen and be financially healthy, Agribank continues to focus resources, make maximum efforts to comprehensively complete the business goals and targets assigned by the State Bank and the goals and targets of the Agribank restructuring plan associated with bad debt settlement by the end of 2025.

Fourth, review and accelerate the implementation of key solutions according to the IT development strategy project for the period 2022 - 2026, with a vision to 2030, and the digital transformation plan to 2025, with a vision to 2030; promote technology application, innovation, and digital transformation according to Resolution 57-NQ/TW of the Politburo. Agribank accelerates the establishment of a Data Center to form core competencies in modern data and analysis, and prepare quality data sources for IT projects and risk management.

Fifth, implement synchronous solutions to improve the quality of human resources in risk management according to Basel III standards, focusing on attracting, training and fostering highly qualified personnel, experts in international standards in banking operations, data analysis, management, digital transformation... to prepare high-quality human resources for the transition period, implementing international standards.

Accelerating digital banking and green finance implementation

Does the Agribank Party Committee have a plan to implement ahead of schedule standards on digital banking, green finance or comprehensive digital transformation? Could you please provide some directions and roadmap for implementation?

Party Secretary, Chairman of the Board of Members of Agribank To Huy Vu: Agribank Party Committee has thoroughly grasped Resolution 52-NQ/TW (2019) of the Politburo and Resolution 57-NQ/TW on breakthroughs in science, technology and digital transformation. Since the beginning of the 2020-2025 term, the Party Committee has issued thematic Resolution No. 01-NQ/DU-NHNo (dated December 25, 2020) on enhancing innovation in science and technology, towards the goal of digital banking.

Agribank launches a breakthrough action program to develop science and technology, innovation and digital transformation throughout the system

Plan No. 77-KH/DU (dated February 28, 2025) and the Action Program to concretize Resolution 57-NQ/TW have been vigorously implemented throughout the system. The Party Committee clearly assigns tasks and regularly supervises the implementation at the Head Office and Branches.

Agribank develops modern digital infrastructure, researches and applies new technologies such as AI, biometrics, cloud computing, API, Blockchain. At the same time, cooperates with Fintech, develops a seamless digital ecosystem for customers and partners.

As a result, the number of transactions increased rapidly, at times reaching nearly 60 million transactions per day; 95% of transactions were automated without increasing operating costs. Agribank was also honored with many awards such as Sao Vang Dat Viet, Vietnam Digital Transformation Award, and 12 IT systems won Sao Khue Awards.

Regarding green finance, Agribank issued a set of ESG standards and developed an implementation roadmap in line with the National Strategy on Green Growth and the Net Zero 2050 target.

The implementation roadmap includes 2 phases:

Phase 2024-2025: Perfecting policies, developing green financial products, and training human resources. By March 31, 2025, outstanding green sector loans will reach over VND 29,000 billion, of which renewable energy accounts for 52%, sustainable forestry 24%, and green agriculture 23%.

Phase 2026-2030: Accelerate green credit growth, expand products, attract international resources and integrate ESG into all activities. The goal is to become a comprehensive Green Bank, approaching international standards.

Prime Minister Pham Minh Chinh, Governor of the State Bank of Vietnam Nguyen Thi Hong took a souvenir photo with the Board of Directors of Agribank at the event Digital Transformation of Banking Industry 2025 with the theme "Smart Digital Ecosystem in the New Era"

With the role of the Party Committee in leading the credit orientation to serve "Tam Nong", in your opinion, what solutions does the Agribank Party Committee need to have to direct the entire system to closely follow policies to adapt to foreign tariff difficulties, accompany the Government, ensure credit is directed to the right subjects - production households, cooperatives, small enterprises, farming households, contribute to risk control, contribute to stabilizing agricultural exports?

Party Secretary, Chairman of the Board of Members of Agribank To Huy Vu: Agribank Party Committee has seriously implemented the Party's Resolutions on agriculture, farmers and rural areas. Agribank maintains 65% of outstanding loans for investment in this sector. By June 2025, outstanding loans reached VND 1.85 million billion, of which VND 1.13 million billion were for agricultural and rural loans with 2.7 million customers.

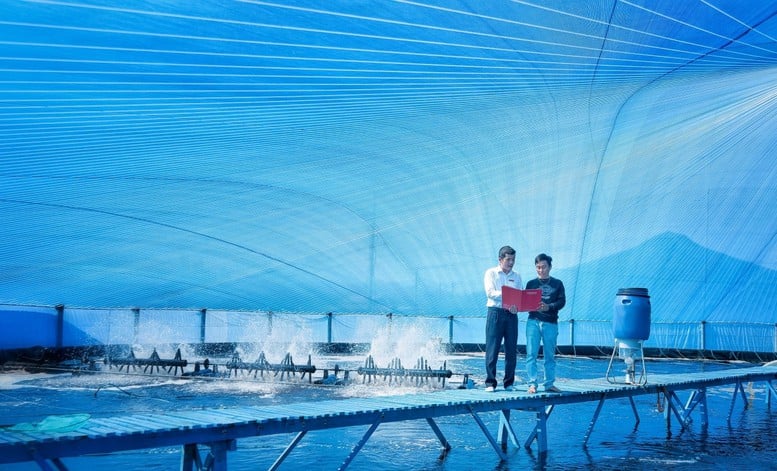

Agribank effectively implements policy credit programs, national target programs on new rural areas, poverty reduction and economic development in ethnic minority and mountainous areas. In addition, Agribank pioneers in bringing green finance to agriculture, supporting circular production and reducing emissions.

Faced with the impacts of the US reciprocal tax policy applied to many countries, including Vietnam, Agribank has proactively reviewed the impact on credit activities, import-export payments, exchange rates and interest rates. The bank has also directed its branches to work directly with affected customers, especially in the agricultural and rural areas, to promptly grasp difficulties, propose support solutions and ensure capital safety.

Agribank - the key bank investing in developing "Tam Nong"

To maintain stable growth for the "Agricultural and Rural Development" sector, the Party Committee and the Board of Directors of Agribank have directed the entire system to continue to prioritize lending to the right subjects such as production households, cooperatives, and small enterprises. In addition, the bank promotes credit associated with risk control, contributing to stabilizing agricultural production and export.

Specifically, Agribank deploys synchronous groups of solutions. First, prioritizing capital for agriculture according to the linkage model and value chain from production to export; providing payment services for high-value agricultural products; while still ensuring credit growth goes hand in hand with business quality and efficiency.

Second, implementing preferential policies under Decree 156/2025/ND-CP, increasing the amount of loans without collateral and supporting customers in difficulty. Furthermore, Agribank expanded the scale of the preferential credit program for agriculture, forestry and fishery, raising the total limit from 3,000 billion to 20,000 billion VND, with a cumulative disbursement of nearly 9,800 billion VND.

Third, actively implement the Project "Sustainable development of one million hectares of high-quality, low-emission rice" in the Mekong Delta, coordinate with the Ministry of Agriculture and Environment and the State Bank to provide preferential loans to participating customers.

Agribank actively implements the Project "Sustainable development of one million hectares of high-quality and low-emission rice cultivation associated with green growth in the Mekong Delta"

Fourth, Agribank coordinates with the political system, Farmers' Association, Women's Association, etc. to expand credit through loan groups; at the same time, develop digital banking services for remote areas, in order to effectively implement the National Financial Inclusion Strategy.

Therefore, with a series of synchronous solutions, Agribank is striving to support customers, promote the development of "Agriculture and Rural Development" and ensure safe operations in a volatile economic context.

Thank you very much!

Huy Thang (Implementation)

Source: https://baochinhphu.vn/agribank-tang-toc-chuyen-doi-so-nang-tam-quan-tri-phat-huy-vai-tro-chu-luc-tam-nong-102250729103445768.htm

![[Maritime News] Container shipping faces overcapacity that will last until 2028](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/30/6d35cbc6b0f643fd97f8aa2e9bc87aea)

Comment (0)