Currently, 80% of Yuanta's total assets are used for margin lending. While lending activities still bring in the main revenue, Yuanta Vietnam's profits still fell sharply in the third quarter.

|

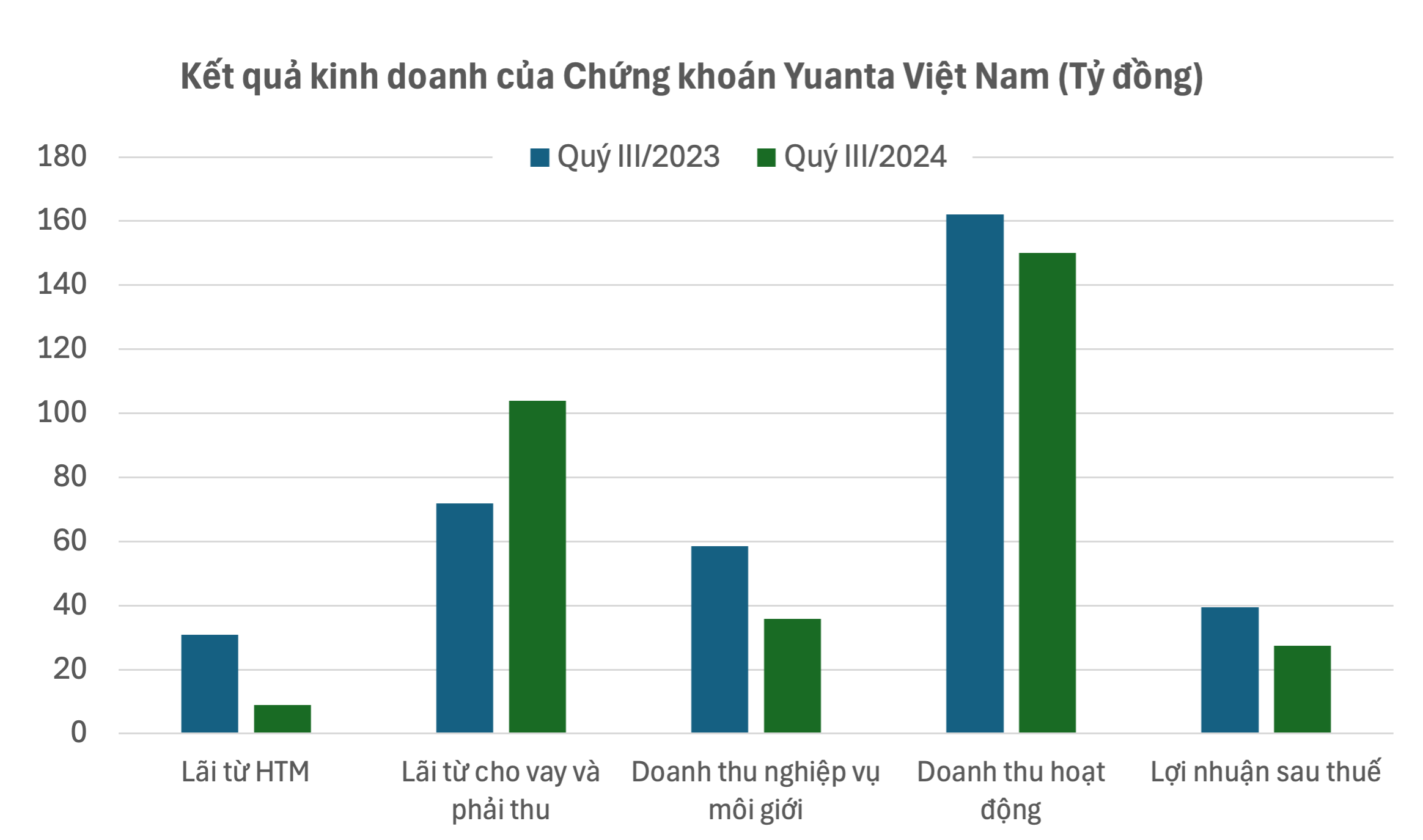

Yuanta Securities Vietnam Co., Ltd. has just announced its financial report for the third quarter of 2024 with results that decreased significantly compared to the same period last year.

In line with the non-proprietary trading principle, Yuanta's revenue mainly comes from lending and securities brokerage activities. Operating revenue in the third quarter reached VND150.7 billion, down 7% compared to the third quarter of 2023.

Of which, interest from loans and receivables contributed the most, accounting for 70% of total revenue, reaching VND1,045 billion. This category increased sharply compared to last year, up to 44%. However, this did not lead to overall revenue growth as brokerage revenue decreased by nearly 40% and interest from held-to-maturity (HTM) investments decreased by 70%.

|

As a result, Yuanta's after-tax profit in the third quarter of 2024 was only VND27.5 billion, down 30% year-on-year. This is Yuanta's first reported profit decline in 2024 after significant growth in the first two quarters of the year.

In the first 9 months of the year, Yuanta achieved VND 245 billion in revenue and VND 98.7 billion in profit after tax, up 13% and 10% respectively over the same period in 2023.

As of September 30, 2024, Yuanta's total assets reached VND5,400 billion, up 16% compared to the beginning of the year. While bank deposits for securities company operations have decreased by more than half, loans have continued to increase.

The majority of Yuanta's assets are in loans worth VND4,325 billion, equivalent to 80% of total assets. The value of margin loans has been increasing continuously and has increased by 41% compared to the beginning of the year, an increase of VND1,270 billion.

Yuanta Securities Vietnam is a subsidiary in which Yuanta Securities Asia holds 94.1% of contributed capital and Yuanta Securities (Hong Long) holds 5.9% of capital, thanks to which Yuanta Vietnam receives large capital support from the parent company.

The first-half management report said a $30 million revolving credit facility was approved with Yuanta Securities Asia but has not yet been implemented.

Meanwhile, Yuanta's third-quarter financial report recorded short-term debt at VND2,217 billion, up 43% compared to the beginning of the year but down slightly by 7% compared to the end of the second quarter of 2024 because the company has paid off some of its outstanding loans at domestic banks. Currently, foreign banks are still Yuanta's main creditors with outstanding debt of VND1,915 billion.

Source: https://baodautu.vn/bom-nghin-ty-dong-cho-vay-margin-loi-nhuan-yuanta-van-di-lui-d227585.html

![[Maritime News] Container shipping faces overcapacity that will last until 2028](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/30/6d35cbc6b0f643fd97f8aa2e9bc87aea)

Comment (0)