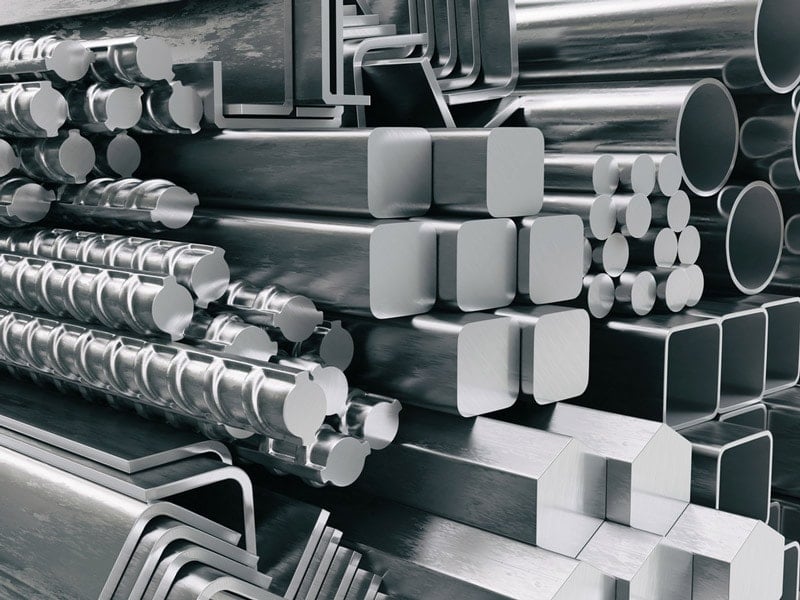

On July 30, the domestic and foreign metal markets witnessed a clear divergence between steel and copper prices. While domestic steel prices remained stable, the international market rebounded strongly after a series of declines, while copper prices simultaneously decreased due to concerns related to US-China trade tensions and the upcoming US tax policy on metals imported from Chile.

World metal prices

In the world market, steel prices recorded positive developments when they rebounded strongly after a series of adjustment sessions. On the Shanghai Stock Exchange, rebar for April 2026 delivery increased by 87 yuan to 3,448 yuan/ton. Other futures contracts such as hot-rolled coil and wire rod increased by 2.01% and 2.33%, respectively, while stainless steel decreased slightly by 0.12%.

Iron ore prices also rebounded. The September contract on the Singapore Exchange rose 1.9% to $102.70 a tonne, holding steady above the $100 mark. The Dalian Commodity Exchange (China) also recorded a gain of 0.63%, equivalent to $111.17 a tonne. Prices were supported by reduced supply at major ports, with inventories falling 7.6% in just one week, according to data from Mysteel.

However, copper prices reversed course and fell amid market sentiment affected by the lack of progress in trade negotiations. On the London exchange, three-month copper futures fell 0.35% to $9,758.50 a tonne. On the Shanghai exchange, they fell 0.18% to 78,840 yuan ($10,985 a tonne).

The main reason is concern ahead of the US imposing a 50% tariff on copper imports from Chile starting August 1. Ships carrying copper are rushing to US ports before the deadline, causing prices to temporarily rise. After this time, many experts predict that prices may face downward pressure due to cooling demand.

In addition, other base metals on the London Stock Exchange also followed the downward trend: aluminum decreased by 0.65%, nickel decreased by 0.45%, zinc decreased by 0.34%, lead and tin decreased by 0.12% and 0.31% respectively. On the Shanghai Stock Exchange, the metals all lost slightly from 0.2% to 0.8%.

Domestic steel prices

In the domestic market, steel prices today are basically flat in all three regions of the North, Central and South. Specifically, in the North, Hoa Phat steel remains at 13,650 VND/kg for CB240 rolled steel and 13,790 VND/kg for D10 CB300 ribbed steel. Viet Y and Viet Sing steels remain at 13,580 to nearly 14,000 VND/kg, respectively, depending on the type. Viet Duc steel has a lower price, fluctuating around 13,550 - 13,690 VND/kg.

In the Central and Southern regions, prices have been similar. Most major steel brands such as Hoa Phat, VAS and Viet Duc have kept their prices the same as the previous session, with common prices around 13,500 - 14,000 VND/kg.

Source: https://baolamdong.vn/gia-kim-loai-ngay-30-7-gia-thep-bat-tang-dong-giam-nhe-do-lo-ngai-thuong-mai-384321.html

![[Maritime News] Container shipping faces overcapacity that will last until 2028](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/30/6d35cbc6b0f643fd97f8aa2e9bc87aea)

Comment (0)