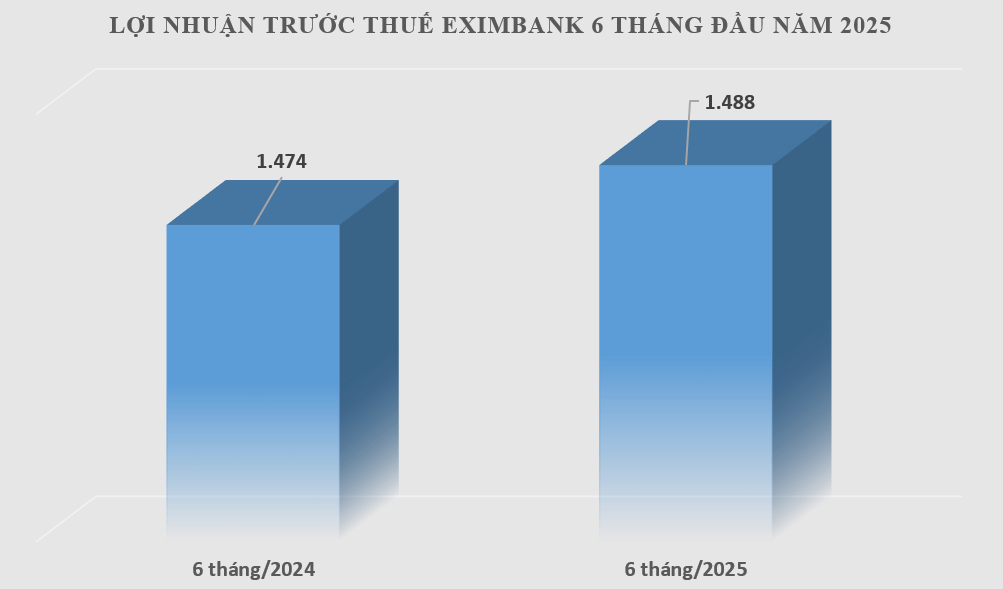

Credit growth of 9.8% in the first 6 months of 2025, along with vibrant foreign exchange and service business activities, pushed Eximbank's pre-tax profit to VND1,488 billion.

Financial picture has many bright spots, credit increased by 9.8%

Vietnam Export Import Commercial Joint Stock Bank (Eximbank, stock code: EIB) has just announced its business results for the first 6 months of 2025, recording pre-tax profit of VND 1,488.5 billion, up 0.97% over the same period. In the second quarter of 2025, Eximbank achieved a profit of VND 656.9 billion.

Net interest income reached VND2,823.8 billion in the first 6 months of the year. Income from service activities in the first 6 months of the year reached VND1,203.9 billion, up 63.3% over the same period, contributing to pushing net profit from service activities to VND338.3 billion, up 43.8% over the same period.

Notably, in the first 6 months of 2025, foreign exchange trading was a breakthrough highlight of Eximbank with net profit from foreign exchange trading reaching VND 364.4 billion, up 76.3% over the same period in 2024. With traditional strengths in international payments and trade finance, international payment activities at Eximbank were bustling with revenue reaching 3.9 billion USD, up 28.3% over the same period. Other activities also brought in VND 250.3 billion for Eximbank. In the first six months of the year, the Return on Assets (ROA) ratio reached 0.47%; Return on Equity (ROE) ratio reached 4.55%.

Eximbank's operating expenses were controlled at VND1,959 billion in the first 6 months of the year, up 24.9% over the same period last year. The increase in operating expenses was mainly due to staff costs, rent and depreciation.

Provision expenses recorded a decrease of VND 328.3 billion, equivalent to a decrease of 34.6% compared to the same period, due to the improvement in asset quality of loans and the absence of some provisions. In the context of a sharp increase in bad debts in the banking industry, with synchronous, flexible and drastic solutions in controlling and handling bad debts, Eximbank's bad debt/loan balance ratio was controlled at 2.66% as of June 30, 2025.

As of June 30, 2025, Eximbank's total assets continued to grow, reaching VND 256,442 billion, up 6.95%, equivalent to an increase of VND 16,673 billion compared to the beginning of the year. Total mobilized capital reached VND 225,517 billion, up 7.36% compared to the beginning of the year. Of which, the CASA ratio (non-term deposits) reached VND 24,141 billion, up 3.6% compared to the beginning of the year.

Eximbank's credit grew positively by 9.8% to VND184,663 billion, focusing on import-export customers, consumer credit... in line with the direction of the Government and the State Bank. The 9.8% credit growth also reflects the needs of businesses and people as well as the positive economic growth momentum of Vietnam.

In the first 6 months of 2025, Eximbank conducted business activities ensuring the operational safety ratio in accordance with the regulations of the State Bank, in which the capital safety ratio CAR fluctuated around 12% (always higher than the regulation of 8% of the State Bank), the ratio of short-term capital used for medium and long-term loans was always maintained lower than the maximum limit of the State Bank of 30%; the LDR ratio was always guaranteed to be below 85% according to the regulations of the State Bank.

In the first 6 months of the year, Eximbank has achieved 28.7% of the 2025 profit plan approved by the 2025 Annual General Meeting of Shareholders (pre-tax profit target of VND 5,188 billion).

In the first 6 months of this year, Eximbank continued to promote the development of digital banking by operating the new Core card system in May 2025. Eximbank was honored as the "Leading Licensee in Merchant Sale Volume 2024". In April 2025, Eximbank won the Sao Khue 2025 award with two technology solutions, ESale and BPM - thanks to their practical application and ability to improve customer experience - factors that have become standards in the digital banking industry.

Not only growing in scale, Eximbank is also active in community activities when organizing the Ho Chi Minh City Night Run Eximbank 2025 attracting more than 5,000 athletes; Blood donation program "Today's blood gives hope - together with Eximbank creating the future"; Gratitude program in Quang Tri - Thua Thien Hue...

Interest rate reduction to accompany people and businesses

Statistics on Eximbank's average lending interest rate in June 2025 were at 7.1%/year, of which the corporate customer segment was only 6.61%/year. This is a low interest rate compared to the general level of commercial banks, clearly demonstrating Eximbank's commitment to accompanying people and businesses in the context of many economic difficulties.

Eximbank representative affirmed that in 2025, the bank has actively lowered lending interest rates, dedicated many support programs for SME businesses following the direction of the Government and the State Bank to support businesses and people in accessing loans, promoting economic growth, bringing the country into a new era.

Eximbank's customer base has grown compared to the beginning of the year, mainly from individual customers. The total number of existing customers of the bank is about 2.6 million.

Strengthen internal strength, create momentum for breakthrough

Eximbank is in a "pivotal" year laying the foundation for a strong breakthrough in the 2026 - 2030 period. The bank is determined to focus on consolidating the foundation, promoting comprehensive transformation, and creating momentum for sustainable growth.

Eximbank is currently working with consulting partners and international experts to comprehensively restructure the bank, build a medium and long-term development strategy, focus on customers, and strengthen the internal audit and risk management system.

Eximbank is also preparing to move its headquarters to Hanoi after receiving approval from the State Bank. This is a strategic turning point in the process of restructuring, repositioning the brand and raising Eximbank's position in the market. This decision reflects a strong shift in leadership thinking, orienting Eximbank to become a bank with modern management, high competitiveness, transparency and efficiency.

Source: https://baolamdong.vn/trust-eximbank-tang-gan-10-nua-dau-nam-2025-384327.html

![[Maritime News] Container shipping faces overcapacity that will last until 2028](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/30/6d35cbc6b0f643fd97f8aa2e9bc87aea)

Comment (0)