Revenue up, profit expected to fall

Amazon, the US e-commerce giant, just announced its Q2 2025 business results with impressive revenue, but its stock price fell about 7% after trading hours.

The reason is that the third-quarter profit forecast missed analysts’ expectations, largely due to the company’s heavy spending on artificial intelligence (AI). Second-quarter revenue reached $167.7 billion, up 13% from last year, beating the $162.2 billion forecast by experts. However, the cost of investing in AI, especially infrastructure, has reduced the expected profit.

In the second quarter, Amazon spent $31.4 billion on AI development, much of it on data centers that support AI models. The company forecast third-quarter operating income of just $15.5 billion to $20.5 billion, lower than the $19.4 billion analysts were expecting.

Third-quarter revenue is forecast to be in the range of $174 billion to $179.5 billion, slightly above the expected $173 billion. Despite revenue growth, heavy spending on AI has led to lower-than-expected profits, worrying investors.

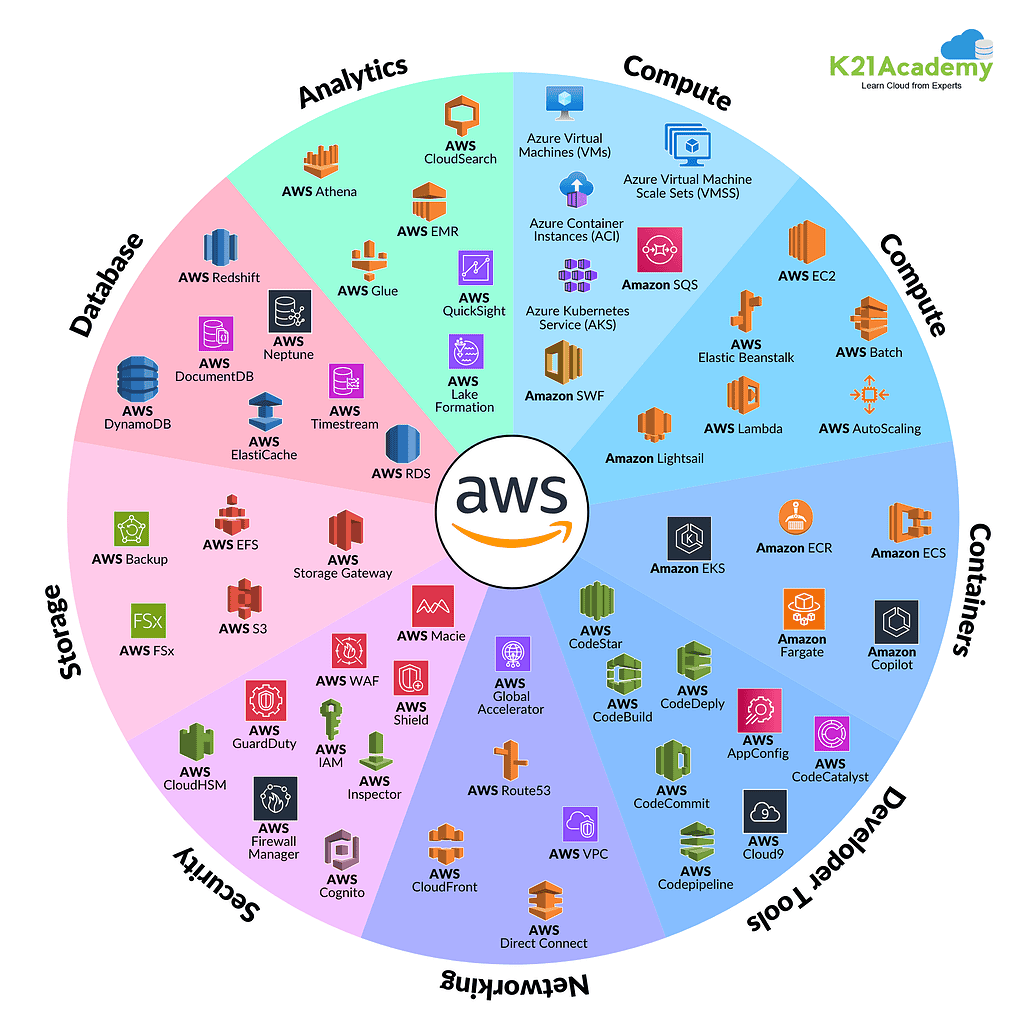

Powered by Amazon Web Services (AWS)

Amazon Web Services (AWS), which provides cloud computing and data center operations, reported a 17.5% increase in revenue to $30.9 billion, in line with Wall Street estimates. However, analysts at Jefferies said the increase was less impressive than competitors like Microsoft and Google. Still, Amazon's second-quarter net profit jumped 35% to $18.2 billion, beating expectations thanks to strong sales.

Amazon is competing fiercely with big tech companies like Microsoft, Google and Oracle to meet the demand for cloud infrastructure for AI.

CEO Andy Jassy said the company will spend more than $100 billion on AI by 2025, calling it “the biggest revolution of our lifetime.” He explained that AI will change every aspect of work, from operations to content creation. However, he also admitted that AWS is undersupplied relative to demand, due to power and processing chip constraints.

Additionally, Amazon is facing challenges from US tariffs. Mr. Jassy said it is still unclear who will bear the increased costs if new tariffs are imposed.

In an uncertain economic environment, Amazon has benefited from strong consumer spending and the delay of higher tariffs. The company has also benefited from the US lifting the duty-free rule for low-value goods from China, helping Amazon better compete with rivals like Temu.

To optimize costs, Amazon is planning to cut staff in some departments while creating new AI-related jobs. Mr. Jassy shared that some existing jobs will require fewer people, but many new jobs will appear.

Still, he said it’s unclear how the company’s overall workforce will change over the next few years. The move shows Amazon is balancing its heavy investment in AI with ensuring business efficiency amid fierce competition.

Microsoft invests record $30 billion in AI, Azure sales explode

Source: https://baonghean.vn/amazon-stocks-decrease-price-due-to-cost-affect-growth-profit-10303654.html

Comment (0)