Domestic gold price today August 3, 2025

As of 4:30 a.m. today, August 3, 2025, the domestic gold bar price increased by more than 2 million. Specifically:

DOJI Group listed the price of SJC gold bars at 121.5-123.5 million VND/tael (buy - sell), an increase of 1.6 million VND/tael for buying - an increase of 2.1 million VND/tael for selling compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 121.5-123.5 million VND/tael (buy - sell), an increase of 1.6 million VND/tael in buying - an increase of 2.1 million VND/tael in selling compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 121.5-123.2 million VND/tael for buying and selling. Compared to yesterday, the gold price increased by 1.1 million VND/tael for buying and 1.8 million VND/tael for selling.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 121.5-123.5 million VND/tael (buy - sell), the price increased by 1.6 million VND/tael in the buying direction - increased by 2.1 million VND/tael in the selling direction compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 120.5-123.5 million VND/tael (buy - sell), gold price increased by 1.1 million VND/tael in buying direction - increased by 2.1 million VND/tael in selling direction compared to yesterday.

As of 4:30 a.m. on August 3, 2025, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 117.-119.5 million VND/tael (buy - sell); the price increased by 1 million VND/tael in both buying and selling directions compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 117.2-120.2 million VND/tael (buy - sell); an increase of 1 million VND/tael in both buying and selling directions compared to yesterday.

The latest gold price list this afternoon, August 3, 2025 is as follows:

| Gold price today | August 3, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 121.5 | 123.5 | +1600 | +2100 |

| DOJI Group | 121.5 | 123.5 | +1600 | +2100 |

| Red Eyelashes | 121.5 | 123.2 | +1100 | +1800 |

| PNJ | 121.5 | 123.5 | +1600 | +2100 |

| Bao Tin Minh Chau | 121.5 | 123.5 | +1600 | +2100 |

| Phu Quy | 120.5 | 123.5 | +1100 | +2100 |

| 1. DOJI - Updated: August 3, 2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 121,500 ▲1600K | 123,500 ▲2100K |

| AVPL/SJC HCM | 121,500 ▲1600K | 123,500 ▲2100K |

| AVPL/SJC DN | 121,500 ▲1600K | 123,500 ▲2100K |

| Raw material 9999 - HN | 109,500 ▲1000K | 110,500 ▲1000K |

| Raw material 999 - HN | 109,400 ▲1000K | 110,400 ▲1000K |

| 2. PNJ - Updated: August 3, 2025 04:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 117,000 ▲1900K | 119,500 ▲1400K |

| Hanoi - PNJ | 117,000 ▲1900K | 119,500 ▲1400K |

| Da Nang - PNJ | 117,000 ▲1900K | 119,500 ▲1400K |

| Western Region - PNJ | 117,000 ▲1900K | 119,500 ▲1400K |

| Central Highlands - PNJ | 117,000 ▲1900K | 119,500 ▲1400K |

| Southeast - PNJ | 117,000 ▲1900K | 119,500 ▲1400K |

| 3. SJC - Updated: 8/3/2025 04:30 - Source website time - ▲/▼ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 121,500 ▲1600K | 123,500 ▲2100K |

| SJC gold 5 chi | 121,500 ▲1600K | 123,520 ▲2100K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 121,500 ▲1600K | 123,530 ▲2100K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 116,500 ▲1900K | 119,000 ▲1900K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 116,500 ▲1900K | 119,100 ▲1900K |

| Jewelry 99.99% | 116,500 ▲1900K | 118,400 ▲1900K |

| Jewelry 99% | 112,727 ▲1881K | 117,227 ▲1881K |

| Jewelry 68% | 73,770 ▲1292K | 80,670 ▲1292K |

| Jewelry 41.7% | 42,627 ▲792K | 49,527 ▲792K |

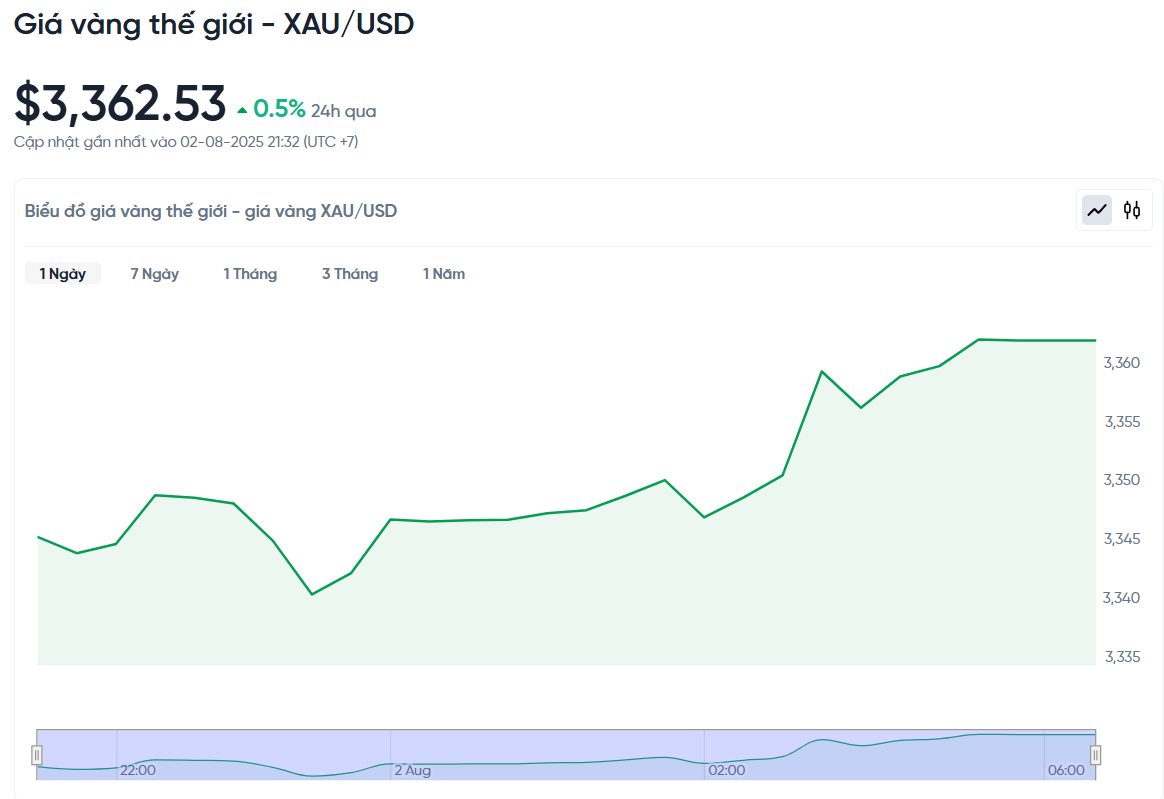

World gold price this afternoon August 3, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:30 a.m. on August 3, Vietnam time, was 3,362.53 USD/ounce. This afternoon's gold price increased by 16.71 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,390 VND/USD), the world gold price is about 110.43 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 13.07 million VND/tael higher than the international gold price.

Gold prices ended the week at a high of over $3,350 an ounce, and according to the Kitco News Weekly Gold Survey, market sentiment is currently very positive.

The week started with gold prices falling sharply after economic data showed the US grew 3% in the second quarter. However, some experts said that the GDP figure did not fully reflect the impact of trade fluctuations.

Few markets can change trends as quickly and dramatically as gold. Just one piece of news or economic data can reverse the price of gold in the blink of an eye.

A statement from Fed Chairman Jerome Powell sent gold prices tumbling. After leaving interest rates unchanged, Powell said, “We haven’t made a decision on September.” Gold prices immediately fell nearly $30 in just one hour. The market immediately adjusted expectations, reducing the probability of a rate cut in September to just 37%.

But things changed over the weekend when the US July jobs report disappointed. According to the Bureau of Labor Statistics, only 73,000 jobs were created, while the May and June employment figures were also revised down sharply. Just two minutes after the data was released, gold prices jumped $30 and continued to climb, closing at $3,362.53 an ounce, up more than 2% on the day.

Gold's strong reaction is understandable. Currently, the market is pricing in a 90% chance that the Fed will cut interest rates in September, and a 50% chance of a total 1% cut before the end of the year. Notably, this expectation comes even as inflation remains high. Experts say this is an ideal environment for gold, as falling real interest rates reduce the opportunity cost of holding the metal.

Another important factor is that investment demand for gold is increasing again. Many investors are looking to gold as a safe haven in times of economic uncertainty.

According to the latest report from the World Gold Council, investment demand for gold ETFs in the first half of 2025 reached the highest level since early 2020. However, the total amount of gold held through ETFs is still much lower than five years ago, showing that there is still plenty of growth potential even when gold prices are near record levels.

Gold Price Forecast

Adrian Day, president of Adrian Day Asset Management, said the US labor market is not as strong as the Fed claims. The weak jobs report increases pressure on the Fed to cut interest rates in September, and this supports gold prices to rise next week.

In this week's survey of 17 experts, none predicted a fall in gold prices, suggesting a consensus of a strong uptrend ahead.

Darin Newsom, senior market analyst at Barchart.com, said that gold prices will continue to rise due to geopolitical uncertainty from the trade war initiated by President Trump. From a technical perspective, the December gold contract has entered a short-term uptrend. The main reason is the start of a new month, accompanied by threats of new tariffs from the US.

Newsom predicted that if negative news about President Trump continues to emerge, the trade rhetoric could become tougher to shift public opinion. In this context, gold will always be considered a safe haven and attract investment flows.

Regarding the outlook for gold prices next week, Marc Chandler, CEO of Bannockburn Capital Markets, said that the weak US jobs report, along with interest rates and a sharp decline in the US dollar, have created a bottom for gold prices. He expects that if gold breaks through the $3,375/ounce mark, it can head towards a target of $3,440.

Naeem Aslam, chief investment officer at Zaye Capital Markets, said that with a sharp shift in interest rate expectations, gold has the opportunity to rise to $3,400 an ounce. He explained that if the Fed signals a rate cut, speculative money could push prices above the important psychological level of $3,400, especially as investors seek safe-haven assets amid economic uncertainty.

Many traders are preparing for a fall rally, in line with seasonal patterns where gold typically rallies after August, according to Aslam. While short-term volatility is still possible, the overall trend is bullish and the summer lull is likely over.

With little major economic data coming next week, markets will continue to digest Friday's jobs report. Meanwhile, experts expect uncertainty from President Trump's trade war to continue to boost demand for gold as a safe-haven asset.

Source: https://baonghean.vn/gia-vang-hom-nay-3-8-2025-gia-vang-trong-nuoc-va-the-gioi-tuan-nay-dao-chieu-tang-vot-chi-trong-1-phien-10303737.html

Comment (0)