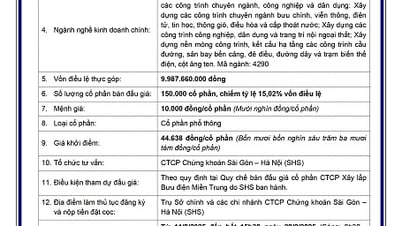

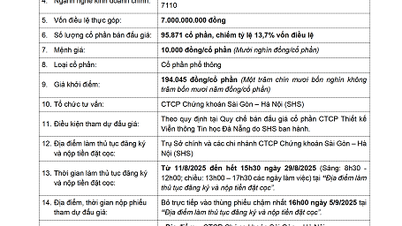

Accordingly, MSB will issue a maximum of 520 million shares to pay dividends from undistributed profits after fully setting aside funds in accordance with the previously approved Charter Capital Increase Plan, equivalent to an issuance rate of 20% of the total outstanding shares. Thereby, the total charter capital will increase from the current VND26,000 billion to a maximum of VND31,200 billion.

Increasing charter capital helps MSB improve its financial capacity, enhance its competitiveness and ensure capital safety indicators according to international standards. Paying dividends in shares helps the bank consolidate its capital buffer, thereby ensuring capital safety indicators when expanding medium and long-term credit space. At the same time, the bank can continue to promote investment in technology infrastructure, effectively developing established strategic plans.

MSB is approved to increase charter capital by up to 5,200 billion VND.

MSB has also just announced its business results for the first 6 months of 2025 with many indicators recording stable growth, demonstrating a controlled development strategy focusing on risk management. The bank recorded pre-tax profit of nearly VND 3,173 billion with total operating income growing positively thanks to the contribution of net interest income and non-interest income. Net interest income reached VND 5,089 billion, up 8% over the same period. Meanwhile, income from service activities increased impressively by 36%, reaching over VND 909 billion.

This result comes from the strong development of payment, treasury, trade finance and digital banking services, reflecting MSB's continuous efforts in digital transformation and improving customer experience. With the effectiveness of digital channels, fee income is expected to increase more strongly in the second half of the year. Along with promoting credit growth and focusing on handling bad debts, the bank is quite confident with the pre-tax profit target in 2025 as committed at the Annual General Meeting of Shareholders at VND 8,000 billion.

In terms of scale, MSB's total assets increased by 7% compared to the end of 2024, reaching 97% of the annual target, thanks to the momentum of credit growth of 13.39% after the first 6 months of the year - exceeding the industry average. MSB also maintained stable asset quality with a separate bad debt ratio of 1.86%, slightly down from the previous quarter. Financial safety indicators were well controlled, with the loan-to-deposit ratio (LDR) reaching 73.91%, the ratio of short-term capital to medium- and long-term loans at 26.57%, and the capital adequacy ratio (CAR) reaching 12.3% as of June 30, 2025.

MSB has also made its mark with many international awards presented by organizations such as Best Core Banking Technology Initiative in Asia- Pacific by The Asian Banker; Best Digital Transformation Retail Bank in Vietnam by Global Banking & Finance Review; Leading Enterprise in Customer Experience Strategy Management by Insider..., proving MSB's continuous efforts in digital transformation to enhance customer experience.

Source: https://dantri.com.vn/kinh-doanh/msb-duoc-ngan-hang-nha-nuoc-chap-thuan-tang-von-dieu-le-len-toi-da-31200-ty-dong-20250808192942884.htm

Comment (0)