VN-Index surpasses 1,400 points

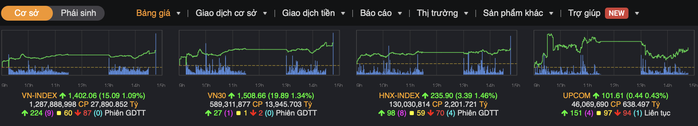

In the trading session on July 7, VN-Index recorded strong growth, surpassing the psychological threshold of 1,400 points after more than 3 years, when it increased by 15.09 points, reaching 1,402.06 points.

The VN30 Index also made an impressive jump of nearly 20 points, up to 1,508.66 points, while the HNX-Index closed at 235.9 points, up 3.39 points. This is a positive signal for the Vietnamese stock market, showing optimism among investors. This transformation could open up new opportunities for investors in the near future.

Liquidity improved significantly this session, with the total trading value of the entire market reaching over VND30,000 billion, of which the HoSE floor alone reached VND28,200 billion. Foreign investors continued to be a bright spot with a net purchase of over VND1,232 billion. Since the beginning of July, foreign investors have returned to net buying nearly VND6,300 billion, a purchase value increase of nearly 50% compared to the last week of June.

Banking stocks, securities stocks and the VN30 bluechip group were strongly collected, anticipating the market's upgrade expectations. In particular, SHB shares of Saigon - Hanoi Bank increased to the ceiling price and had extraordinary transactions, nearly 250 million units, worth VND3,377 billion, accounting for a large proportion on the floor. This momentum spread to many other bank stocks.

VN-Index increased by 15.09 points to 1,402.06 points, officially surpassing the psychological threshold of 1,400.

Index could rise to 1,663 points

In the latest report, Vietcombank Securities Company (VCBS) assessed that the valuation of VN-Index is equivalent to the regional average, forecasting P/E to fluctuate between 13.9x - 15.3x in 2025.

Accordingly, VN-Index could reach 1,555 points, EPS increase by 12%. In a positive scenario when the market is upgraded, the index could reach 1,663 points, attracting an additional foreign capital flow of 1.3 - 1.5 billion USD in the third quarter of 2025.

In the macroeconomic and stock market report for the second half of 2025 titled "Trend following", SHS Securities Company predicts that the market can completely break out, heading towards the price range of 1,420 points.

Mr. Huynh Anh Tuan, General Director of VikiBankS Securities, commented that the market is benefiting from many positive factors. The second quarter macro economy is improving, a series of policies to remove difficulties for infrastructure projects and public investment are being strongly implemented. In addition, the Government's determination to upgrade the market is also strengthening confidence, strongly attracting foreign capital to return.

Source: https://nld.com.vn/tien-o-at-vao-chung-khoan-vn-index-vuot-1400-diem-sau-3-nam-196250707150316209.htm

Comment (0)