F88 listed at 634,900 VND/share

The Hanoi Stock Exchange recently announced that shares of F88 Investment Joint Stock Company (stock code: F88) will officially be traded on the UPCoM market from August 8.

Notably, the reference price on the first trading day was determined to be VND634,900/share, equivalent to a capitalization of VND5,244 billion. This price is quite high compared to the current market price of the financial group on the stock exchange.

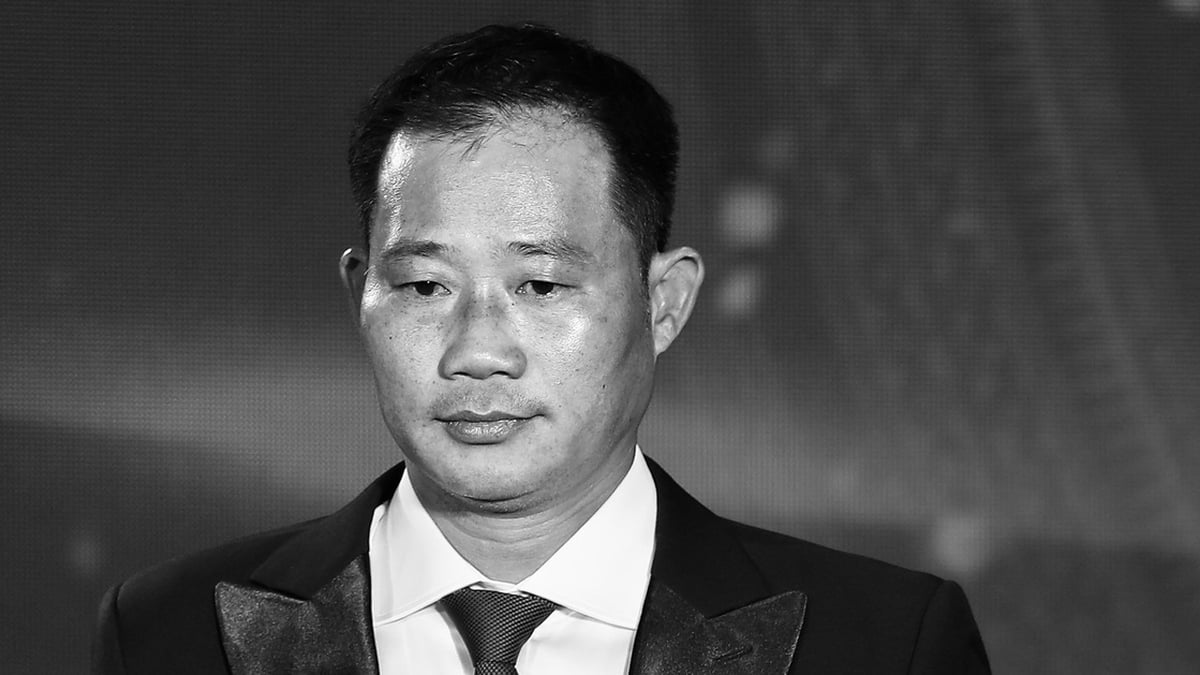

In a previous share, Mr. Phung Anh Tuan - founder and Chairman of the Board of Directors - also said that the company aims to achieve a capitalization of about 1 billion USD when listed on the Ho Chi Minh City Stock Exchange (HoSE) in 2027.

F88 was established in 2013, as introduced as a pioneer in the secured lending chain model serving small and micro enterprises, and individual customers in Vietnam.

This type of business originated from the founder's own circumstances, Mr. Tuan himself was in dire straits due to his previous business not being successful and had to run around everywhere. From there, Mr. Tuan realized the potential of providing a streamlined loan solution for individuals and businesses.

In terms of business results, F88's revenue has grown continuously, the company has reported profits since 2018. In 2023, F88 unexpectedly suffered a record loss. In 2024, profits recovered strongly to 362 billion VND.

In the second quarter of 2025, the company recorded revenue of VND925 billion - an increase of 30% and pre-tax profit of VND189 billion, an increase of 220% over the same period. The results came from accelerating disbursement, up 47% and increasing the scale of outstanding loans by about 45% combined with continuing to maintain discipline in risk management.

F88 revenue over the years (billion VND)

F88's profit over the years (billion VND)

In fact, not only F88, many businesses listed on the stock exchange with sky-high reference prices attracted attention. However, the market price after listing was also quickly adjusted, depending on market conditions as well as supply and demand.

How are the "super stocks" doing now?

In the same financial sector, Techcombank was listed on HoSE in 2018 with the stock code TCB. The reference price on the first trading day was VND128,000/share - the highest price in the bank stock portfolio at that time. At this price, the bank's capitalization at that time reached VND149,000 billion.

After about 7 years, up to now, TCB's price has been adjusted to 34,100 VND/share. It is known that after being listed, Techcombank has increased its charter capital 6 times, currently reaching 70,450 billion VND.

In other industries, the most recent is the listing of VNG Corporation. In January 2023, nearly 36 million VNZ shares were listed on UPCoM with a reference price on the first day of up to VND 240,000/share, equivalent to a valuation of nearly USD 350 million.

After that, VNZ's market price exceeded 1 million VND/share, becoming the most expensive stock on the market. However, VNZ's market price has now adjusted to 415,600 VND/share.

VNZ stock trading (Screenshot).

Equally sensational is the stock YEG of Yeah1 Group Joint Stock Company. First listed on the stock exchange in June 2018, the company announced the opening price of this stock at VND250,000/unit.

At that time, Yeah1 became a hot topic in the financial world because it was the first television and entertainment company to be listed. At the end of the first trading session, YEG even reached VND300,000/share.

After the incident of YouTube abruptly terminating the contract, Yeah1's business situation fell into crisis, causing the stock price to plummet. Currently, the code YEG is only 13,900 VND/share.

Yeah1's YEG stock transaction (Screenshot).

In 2019, Statistical Form Printing and Publishing Company Limited also listed its shares with the code IPH, the reference price on the first trading day was up to 411,000 VND/share. However, on the first trading session, IPH dropped to the floor price to 246,600 VND/share and continued to adjust strongly.

By April 2022, IPH received a decision to cancel its trading registration on the grounds that the company was an equitized enterprise that had registered for trading on the UPCoM trading system before the effective date of Securities Law No. 54/2019/QH14 but had not yet been confirmed by the State Securities Commission to have completed the registration of a public company, which was a case of canceling trading registration.

Source: https://dantri.com.vn/kinh-doanh/cac-sieu-co-phieu-chao-san-voi-gia-tren-200000-dong-gio-ra-sao-20250803155023976.htm

Comment (0)