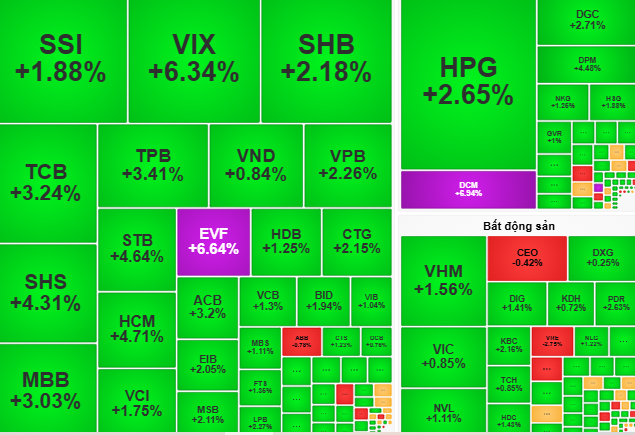

At the end of the session on August 6, VN-Index closed at 1,573 points, up 26 points, equivalent to 1.72%.

Vietnam's stock market opened with an increase on August 6, continuing the upward momentum of the previous two sessions. Banking stocks and Hoa Phat Group's HPG were the main drivers supporting the VN-Index.

On the contrary, Vingroup stocks adjusted down, somewhat affecting the market's upward momentum. The highlight of the morning session was the breakthrough of seafood, fertilizer - chemical and retail stocks, with codes such as ANV, IDI, DCM reaching ceiling price increases.

The afternoon session was similar to the morning session, with some uptrend movements. In addition to the stocks that increased sharply in the morning session, the afternoon session saw the participation of the securities and oil and gas groups, and especially the price reversal of Vingroup stocks (VIC, VHM).

At the end of the session, VN-Index closed at 1,573 points, up 26 points, equivalent to 1.72%.

According to VCBS Securities Company, cash flow is still circulating, supporting the short-term uptrend of VN-Index. Large-cap stocks continue to lead the market, while mid-cap stocks such as securities, oil and gas and seafood also recorded impressive increases, showing the spread of cash flow.

However, many investors are concerned that in the session on August 7, stocks that have increased sharply in recent sessions may face profit-taking pressure.

Therefore, VCBS Securities Company recommends that investors take advantage of speculative cash flow to disburse into stocks that still have room to increase in price compared to the nearest peak or resistance, or open positions with stocks that have their own growth stories. At the same time, investors should limit buying new stocks that have increased strongly to avoid the risk of correction.

Dragon Capital Securities Company (VDSC) recommends that investors should observe supply and demand developments to assess the market's ability to increase points, consider taking short-term profits during the recovery phase, and limit chasing stocks that have increased in price.

Source: https://nld.com.vn/chung-khoan-ngay-mai-7-8-co-phieu-lon-con-tang-diem-hay-bi-chot-loi-196250806174423883.htm

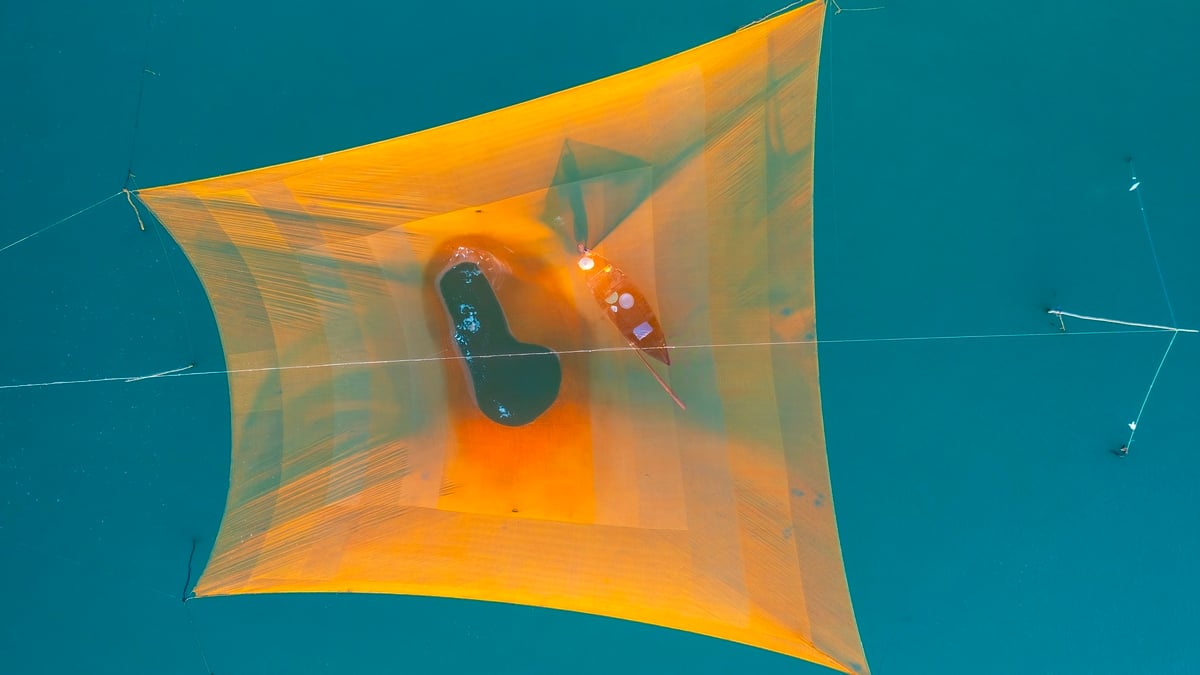

![[Photo] Discover the "wonder" under the sea of Gia Lai](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/6/befd4a58bb1245419e86ebe353525f97)

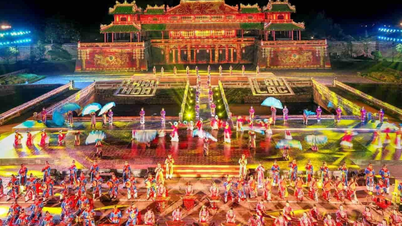

![[Photo] Nghe An: Provincial Road 543D seriously eroded due to floods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/5/5759d3837c26428799f6d929fa274493)

Comment (0)