The wave of "leaving" the USD

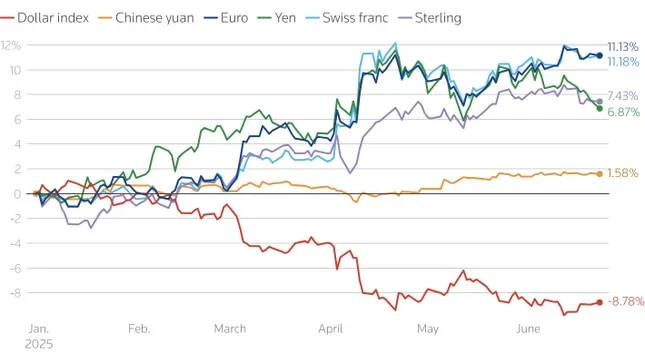

According to the latest data, compared to major currencies, the US dollar has fallen to its lowest level in more than 3 years. Global investors are gradually withdrawing from assets priced in USD, from stocks to bonds, creating widespread pressure across the market.

Data shows that foreign investors America are leading the trend of divesting from dollar-denominated assets. Specifically, European pension funds and insurance companies cut their dollar holdings to the lowest level since 2022 in just a few weeks in the second quarter of this year.

Trading sessions in Asia also witnessed a sharp decline in the USD, which shows that regional investors, especially those holding US bonds, are also actively hedging exchange rate risks.

While U.S. stocks have attracted $17.6 trillion in foreign ownership, compared with $13.6 trillion in bonds, foreign ownership of bonds is much higher. International investors hold 33 percent of the U.S. Treasury bond market and 21 percent of the corporate and government bond market, compared with just 18 percent of stocks. Investors from the eurozone alone account for 25 percent of all foreign ownership of U.S. stocks.

G10 investors are estimated to hold $13.4 trillion in unhedged dollar assets, with $9.3 trillion in equities and the rest in bonds. A modest 5% pullback would trigger $670 billion in outflows, much of it from Europe.

In Asia, the selling pressure on US Treasuries is evident. Asian investors now own about a third of foreign holdings of US government bonds. A large portion of assets held by institutions in the eurozone, the UK or the Caribbean are actually owned by China and other Asian countries.

Since 2014, eurozone investors have bought about $3.4 trillion in foreign bonds, mostly U.S. debt, during a period of negative interest rates in Europe. Even a slight adjustment in investment strategies could put significant pressure on the U.S. bond market.

Bank Central “pivot”: USD gradually loses its dominant reserve position

Not only the private sector, central banks around the world , the forces that once considered the USD a "safe haven" are also changing their strategies.

According to a new survey by the Official Monetary and Financial Institutions Forum (OMFIF), one-third of the 75 central banks surveyed (managing about $5 trillion in reserves) said they would increase their gold holdings in the next 1-2 years. The attractiveness of the US dollar has fallen sharply, falling from the most popular currency last year to the current 7th place.

About 70% of central bankers said the political environment in the US is unstable, especially after the upheavals caused by policy tax President Donald Trump's remarks on Liberation Day on April 2 are a factor that makes them hesitant to invest in USD and US bonds.

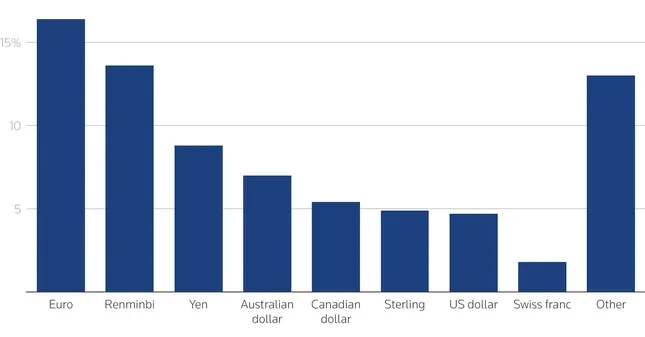

In contrast to the weakening dollar, the euro and the renminbi are emerging as the leading alternatives. In the short term, 16% of central banks plan to increase their euro reserves, up from 7% last year. The renminbi is now the second-most preferred reserve currency. In the long term, 30% of central banks plan to increase their renminbi reserves over the next 10 years, which could see the currency account for 6% of global reserves, triple its current share.

The euro is also expected to recover strongly, especially if the EU promotes capital market integration and develops a common bond market - an area that is still inferior to the US. Some experts such as Francesco Papadia (ECB) or Kenneth Rogoff (Harvard) believe that the share of the euro in global reserves could reach 25% in just the next 2 years.

For years, central banks have been the long-term buyers of US assets, but as they begin to withdraw from the dollar and seek alternatives such as gold, the euro and the yuan, the global monetary order is undergoing a significant restructuring.

The decline in confidence in “American economic superiority” combined with geopolitical volatility is making investments that were once considered sustainable vulnerable to reversal. While there are no signs of a large-scale flight from the dollar, the quiet movements from both the private and public sectors are creating significant headwinds that will likely continue for some time to come.

Source: https://baoquangninh.vn/dieu-nghiem-trong-dang-xay-ra-voi-dong-usd-3363940.html

Comment (0)