Fed keeps interest rate at 4.5%, gold price 'evaporates' 60 USD

As expected, the US Federal Reserve (Fed) in its two-day meeting ending in the early morning of July 31 (Vietnam time) decided to keep the benchmark interest rate at 4.25%-4.5%/year with 9 votes in favor and 2 votes against.

The decision did not come as a surprise as the market had been largely certain that the Federal Open Market Committee (FOMC) - the decision-making body at the Fed - would not ease monetary policy despite pressure from the Trump administration. US inflation remains high and a strong labor market is supporting the Fed's decisions.

The FOMC's decision was further reinforced when the US Department of Commerce just released preliminary data showing that the US's second quarter GDP increased impressively, erasing the fear of an economic recession that has haunted investors for many months.

US GDP grew 3% in the second quarter, offsetting a 0.5% decline in the first quarter. The GDP growth rate just announced was much higher than the 2.5% increase forecast by economists.

However, what many investors are concerned about is that the Fed's economic outlook has not changed much. The US monetary policy-making agency believes that the US unemployment rate remains low and labor market conditions remain strong. Inflation remains high.

The above signal shows that the Fed will remain cautious and continue to rely on economic data to shape monetary policy. The possibility of a rate cut at the upcoming meeting (on September 17) is still quite high, but not overwhelming.

In addition, comments from Fed Chairman Jerome Powell dampened hopes of a rate cut in September. Mr. Powell reaffirmed that the US central bank is in no rush to cut interest rates. The Fed Chairman explained that the labor market, consumer activity and the economy in general are still relatively strong and important economic data still need to be assessed before the September policy meeting.

Mr. Powell's failure to provide policy direction caused a sell-off in the gold market.

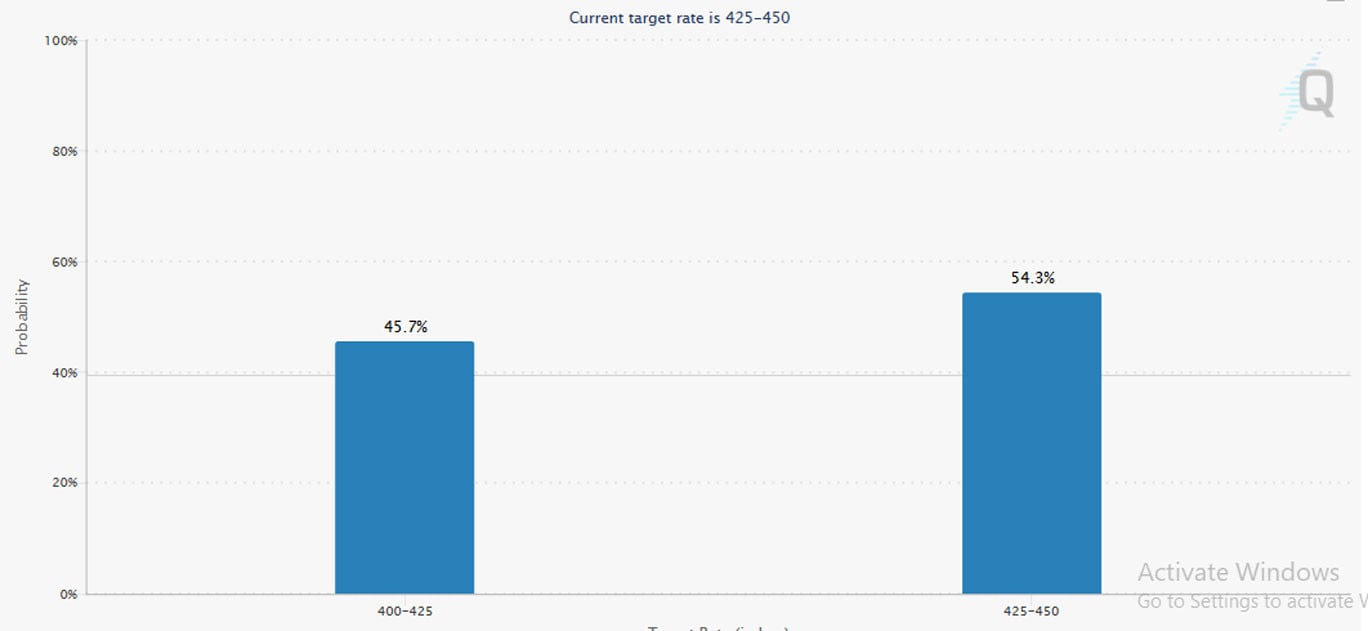

As of 6:00 a.m. on July 31 (Vietnam time), according to signals from the CME FedWatch tool, the market is betting on a 45.7% chance that the Fed will cut interest rates by 0.25 percentage points on September 17 and a 53.3% chance that the US central bank will keep interest rates at 4.25-4.5%/year at that meeting.

Thus, the betting rate on the possibility of the Fed cutting interest rates at the September meeting has decreased sharply compared to last night, with the market betting 57.9% chance that the Fed will cut interest rates by 0.25 percentage points on September 17 and 1.8% chance that the Fed will cut by 0.5 percentage points; 40.2% chance that interest rates will remain at 4.25-4.5%/year.

With the latest signals from the Fed, the USD has increased sharply. The DXY index - measuring the greenback's fluctuations against a basket of 6 major currencies in the world - increased by more than 1% to 99.89 points.

Due to the pressure from a strong USD, the price of gold has plummeted. In the early morning of July 31, the price of gold fell below 3,270 USD/ounce (equivalent to 105 million VND/tael). Compared to 7:00 p.m. on July 30, the price of gold has decreased by more than 60 USD/ounce.

Immediately after the Fed’s decision, profit-taking pressure on US stocks also increased. Stock indexes fell, leaving their recent historical peaks. The Fed’s “hawkish” stance on monetary policy will control money pumping, thereby restraining economic growth.

Oil prices meanwhile rose sharply. WTI crude rose 0.36% to $70.25 a barrel.

Fed more cautious

However, the Fed's assessment also contained more caution about the economic outlook.

The FOMC no longer believes that the US economy will "continue to expand at a solid pace" as it did in its June assessment, but instead predicts that uncertainty "will remain high."

At the last FOMC meeting, consensus among the committee members also weakened. Two of the 11 members voted against. This was the first time since late 1993 that two governors opposed an interest rate decision.

On Kitco, Northlight Asset Management Chief Investment Officer Chris Zaccarelli said that while the Fed's statement did not provide much new information for investors, Chairman Powell did drop some hints in his press conference that the likelihood of a rate cut is higher at the next meeting in September.

Mr. Powell noted that most measures of long-term expectations remain consistent with the 2% inflation target and said the inflation impact from tariffs would likely be “short-lived.”

LPL Financial chief economist Jeffrey Roach also expects the Fed to start cutting rates after the summer.

According to the forecast chart, Fed officials expect two rate cuts this year.

President Donald Trump has repeatedly called for Powell to resign and even considered firing him. The Trump administration has sought to find fault with the Fed, including overspending on the project to rebuild two Fed buildings in Washington.

However, interfering with central bank operations often has far-reaching consequences, something that even US Treasury Secretary Scott Bessent has recently said is a testament to the Fed’s independence.

Mr. Trump also proposed that the Fed cut its benchmark interest rate by 3 percentage points to help reduce the cost of national borrowing and give a boost to the stagnant real estate market.

The Fed has been more cautious about raising interest rates this year amid concerns that President Donald Trump’s trade policies could push up inflation. But those concerns have eased recently after the U.S. government announced new trade deals with Japan and the European Union that include a 15% import tax increase.

Source: https://vietnamnet.vn/fed-cung-ran-truoc-ong-trump-gia-vang-roi-thang-dung-2427250.html

Comment (0)