While input costs may cool down, helping to reduce pressure on businesses, competition between supply sources is also becoming fiercer...

Abundant supply, world corn prices fall to 5-year low

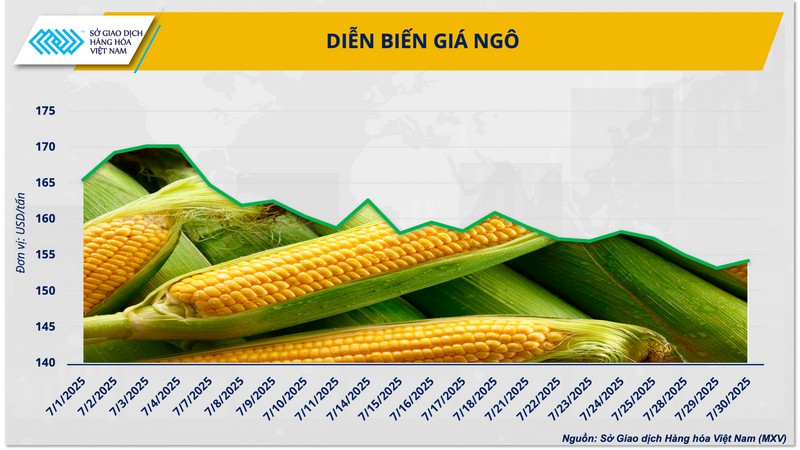

From mid-April to mid-July 2025, world corn prices fell into a prolonged decline, interspersed with a few weak recoveries. In just three months, corn prices fell from $194/ton to $155/ton, the lowest level in the past five years.

According to the Vietnam Commodity Exchange (MXV), the main reason comes from bumper yields in most major exporting countries. In the US – the world’s largest corn producer, 74% of the planted area is rated as good to excellent quality, the highest rate in nearly a decade. The US Department of Agriculture (USDA) forecasts that the 2025-2026 crop year output could reach 400 million tons.

Brazil, the second largest exporter, is also entering its second corn harvest with an estimated output of 102-106 million tons. AgRural (Brazil) recently revised up its forecast for the country's total corn output in 2025 to a record 136 million tons, up sharply from the previously announced 130.6 million tons. Argentina follows with 53-54 million tons, exceeding the 5-year average of 49 million tons.

Compiling data, the International Grains Council (IGC) estimates global corn production in the 2025-2026 season will reach 1.27 billion tons, far exceeding the previous season's 1.22 billion tons and approaching global consumption.

On the other hand, global demand is slowing down. China, the world’s largest corn importer, is pushing for domestic self-sufficiency. The USDA has just raised its forecast for China’s corn production to 298 million tons, while imports have dropped sharply to around 8 million tons – much lower than in previous years.

In addition, trade policy factors also create complex impacts on the market. MXV believes that the above supply-demand imbalance will continue to put pressure on corn prices in the coming time. In the short term, corn prices will fluctuate in the range of 155 USD/ton and will find it difficult to recover strongly without supporting factors such as unfavorable weather in the US or sudden increase in demand from China. In a negative scenario, corn prices may fall to the range of 140 USD/ton.

On the contrary, if there is positive supporting information, such as the US facing adverse weather or a large demand from China, corn prices could rebound to the levels of 163 - 172 USD/ton.

Opportunity to reduce costs, create a new growth cycle for the livestock industry

Although world corn prices have fallen sharply, the corn price offered at ports (CFR) in Vietnam is still quite high, ranging from 6,400 - 6,750 VND/kg, equivalent to 240 - 250 USD/ton. This price is significantly higher than the spot corn price on the world market, currently only about 155 USD/ton.

The main reason is the delay between the time the contract is signed and the time the goods arrive at the port, causing the import price to not have time to adjust to the market. In addition, additional costs such as international transportation, storage, inspection, VAT and domestic logistics costs also push the price of imported corn higher than the world price.

This difference shows that freight rates and logistics costs are still major determinants in the price structure of corn imported into Vietnam, and also shows the slow response of the domestic market to global fluctuations - especially in the context of global supply surplus and international corn prices continuing to be under downward pressure.

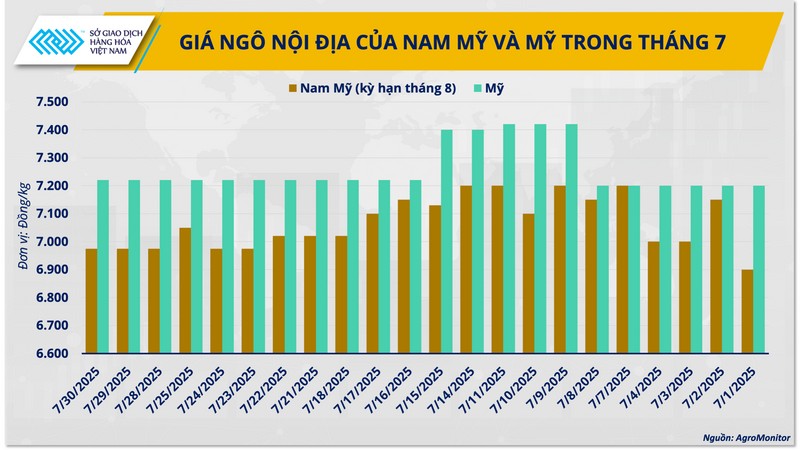

Currently, corn imported from Argentina, Brazil and Laos enjoys a 0% tax rate according to Decree 73/2025/ND-CP and free trade agreements (FTAs). Meanwhile, corn from the US was previously subject to a 1-2% tax and has only been exempted from tax since March 31, so it has not yet been fully reflected in market prices. Therefore, the price of US corn is still about 200 VND/kg higher than that of South American corn.

Data from the General Department of Customs shows that in the first 5 months of 2025, Vietnam imported more than 4 million tons of corn. Argentina led with nearly 2 million tons (nearly 50%), followed by Brazil (1 million tons), the rest from Laos, Thailand, India, etc. American corn only accounted for a small proportion because the price was not competitive enough.

However, the quality of American corn is still considered higher with superior integrity, protein content and cleanliness - suitable for industrial processing and farming standards. Meanwhile, South American corn has a lower price but often has problems with moisture and preservation during transportation.

In the context of pork and chicken prices remaining low, the decrease in corn prices and abundant supply are important “lifesavers” for livestock businesses, where feed costs account for 65–70% of total production costs.

Even some big names in the animal feed industry in Vietnam have proactively developed plans to import raw materials for both this year and 2026, with US corn on the priority list thanks to its quality advantages and 0% tax policy.

By signing long-term contracts in the form of FOB or CIF, many businesses are "locking prices" at low levels, minimizing the risk of market fluctuations and ensuring stable supply for the peak consumption period at the end of the year.

The combination of falling world prices, abundant supply, and favorable tariff policies is opening the door to restructuring input materials for Vietnam’s livestock industry . If businesses take advantage of this opportunity, they can enter a new growth cycle – more efficient, more sustainable, and more competitive in the international market.

Source: https://baolaocai.vn/gia-ngo-re-chat-luong-cao-co-hoi-tai-co-cau-nguon-cung-cho-nganh-chan-nuoi-post650192.html

Comment (0)