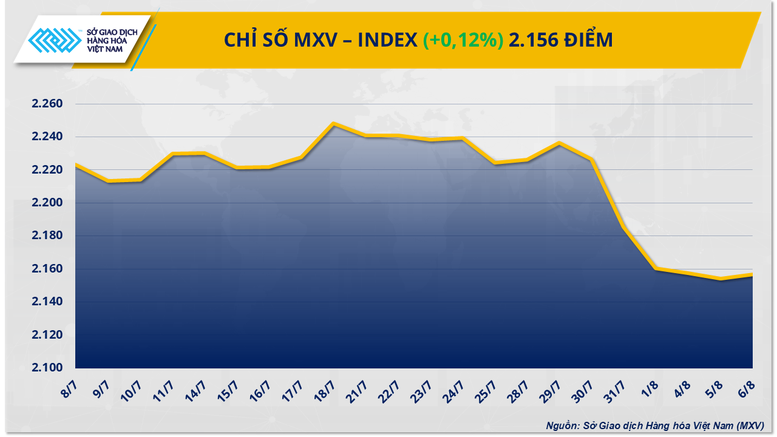

Platinum price fluctuates above $1,300/ounce

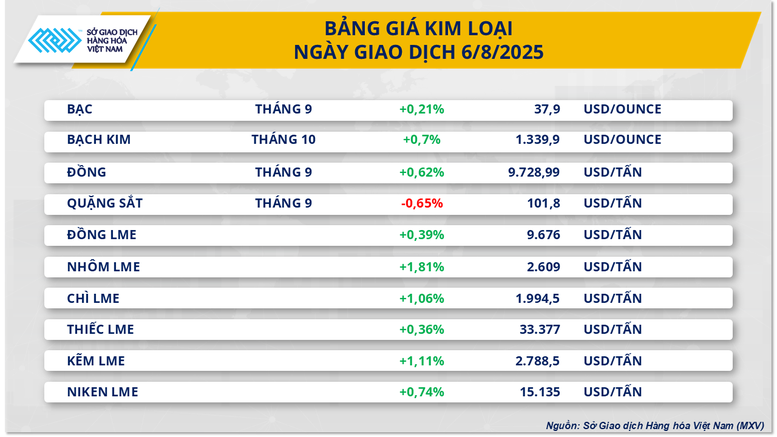

Closing the trading session on August 7, green covered the metal market in the context of a weakening USD and a prolonged supply shortage in some metal products.

Platinum prices reversed and increased by 0.7% to $1,339/ounce. Previously, at the end of July, profit-taking pressure along with the strengthening of the USD caused platinum to have a series of downward adjustments for 8 consecutive sessions, falling from the highest peak in 11 years.

In yesterday's trading session, the US dollar index continued to fall by more than 0.6% to 98.18 points - extending a series of 4 consecutive sessions of weakness. The weaker USD has made commodities priced in the greenback such as platinum more attractive to investors using other foreign currencies, thereby stimulating demand in the market. In addition, strong import demand and supply shortages in key producing countries were also important factors contributing to the recovery of this group of precious metals in the last session.

In the world's largest consumer market, data from the General Administration of Customs of China (GACC) showed that the country's platinum imports in June reached 11.8 tons, equivalent to about 379,000 ounces - three times higher than the same period last year. In the second quarter alone, China imported 35.9 tons of platinum, equivalent to 1.2 million ounces, up 26% over the same period last year.

According to statistics from the research department of Standard Chartered Bank, this import volume is continuously higher than domestic consumption, showing that the demand for storage in China has been increasing in recent years.

In the US, data from the International Trade Center (ITC) shows that the amount of raw platinum imported in the first 5 months of this year reached 27.1 tons, up slightly by 1% compared to 26.9 tons in the same period last year. Notably, the trend of hoarding this precious metal has shown signs of increasing as concerns about changes in tariff policies in Washington have prompted businesses to increase imports, taking advantage of price differences. As of August 6, platinum inventories in storage facilities in the US had reached 565,940 ounces - 3.6 times higher than the same period last year.

On the supply side, according to Morgan Stanley, platinum production in South Africa - the world's leading producer of this precious metal - has decreased significantly in the first 4 months of 2025. The World Platinum Investment Council (WPIC)'s first quarter report also emphasized that severe weather with heavy rains causing flooding in some mines has caused South Africa's refined platinum production in this quarter to decrease by 10% compared to the same period, recording the lowest level since 2020.

It is forecasted that platinum production in South Africa may decrease by 6% compared to the previous year in 2025, to only about 3.9 million ounces. This will lead to a corresponding decrease in global mining output of 6%, expected to reach 5.4 million ounces - the lowest level in many years. In particular, with more than 77% of the global platinum supply concentrated mainly in South Africa, any fluctuations or disruptions in production activities in this country can have a strong impact on the supply-demand balance and platinum prices on the international market.

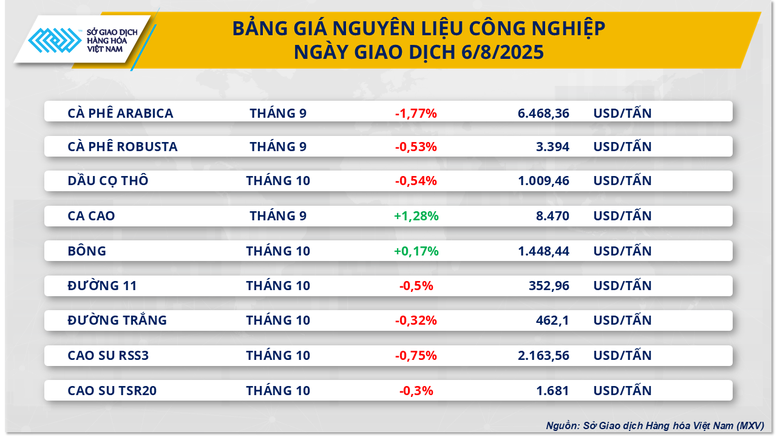

World and Vietnamese coffee markets are quiet

On the other hand, the industrial raw material group witnessed overwhelming selling pressure on most key commodities. Of which, Arabica coffee prices lost nearly 1.8% to 6,468 USD/ton, Robusta coffee prices also recorded a decrease of more than 0.5% to 3,394 USD/ton.

According to MXV, the downward pressure on prices comes from a series of positive information about supply in major coffee producing countries around the world.

Source: https://baochinhphu.vn/mxv-index-phuc-hoi-sau-5-phien-xuong-doc-bach-kim-dan-dat-da-tang-10225080709033326.htm

![[Photo] Nghe An: Provincial Road 543D seriously eroded due to floods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/5/5759d3837c26428799f6d929fa274493)

![[Photo] Discover the "wonder" under the sea of Gia Lai](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/6/befd4a58bb1245419e86ebe353525f97)

Comment (0)