On August 8, F88 Investment Joint Stock Company will officially list more than 8.26 million shares on UPCoM, according to a decision just announced by the Hanoi Stock Exchange (HNX).

F88 stock price highest in the market

With a total registered value of more than VND 82.6 billion, this event marks a new turning point in the development journey of the largest mortgage lending enterprise in Vietnam.

What is most notable is that the reference price in the first trading session of F88 was determined at 634,900 VND/share, the highest on the Vietnamese stock market today.

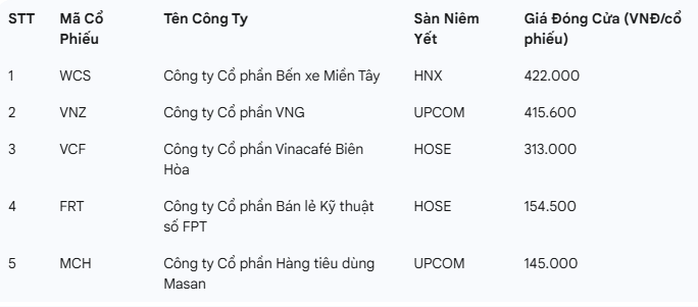

This price is far beyond the codes that are holding the "throne" in terms of market price such as WCS (Mien Tay Bus Station) at 422,000 VND, or VNZ shares of the technology "unicorn" VNG , which is stopping at 415,600 VND.

Even big names like Vinacafé Bien Hoa (VCF), FPT Retail (FRT) or Masan Consumer (MCH) are also ranked behind with market prices of VND313,000, VND154,500 and VND145,000 respectively.

The highest priced stocks on the stock exchange as of August 1, 2025

According to information from F88, the reference price is based on careful calculations from the audited financial report for 2024, in which the book value is currently around VND 209,000/share, a very high number compared to the current market level.

At the 2025 Annual General Meeting of Shareholders held not long ago, the issue of the listing price and the possibility of a price reduction when listed on UPCoM was hotly discussed by shareholders. Many investors expressed concern that with the listing price being too high, the opportunity to access stocks would become out of reach for most of the market.

F88 is the largest pawn company to date.

Mr. Phung Anh Tuan talks about F88 stock price

Responding to this concern, Mr. Phung Anh Tuan, Chairman of the Board of Directors of F88, affirmed that the stock price when listed on the stock exchange has been carefully considered to ensure the harmony of the interests of existing shareholders as well as attracting new investors. “If the price is too high, it will be difficult to attract new shareholders. But if it is too low, current shareholders will suffer. The price is not entirely decided by the enterprise, but requires consensus and approval from the HNX,” he emphasized.

Mr. Tuan also affirmed his belief in the market's fair assessment: "Investors are very smart. They will see for themselves the true value and growth potential of the business. If the stock falls to an attractive level, the market will react accordingly."

In terms of business results, F88 is proving that its appeal lies not only in its valuation but also in its strength. In the first half of 2025, the company recorded a total revenue of VND 1,744 billion, an increase of 30% over the same period last year. Of which, the core business of mortgage lending contributed VND 1,521 billion, an increase of 28%. In particular, pre-tax profit reached VND 321 billion - an impressive growth of 213%, showing that the profit margin is improving strongly.

Speaking with Nguoi Lao Dong Newspaper, an analysis director of a securities company commented that with newly listed stocks, prices often need time to "establish a new level", after supply and demand are absorbed by the market and reflect their true value.

Source: https://nld.com.vn/vi-sao-co-phieu-cong-ty-cam-do-f88-len-san-co-gia-cao-nhat-thi-truong-chung-khoan-19625080315450297.htm

Comment (0)