Investing is not a game of chance, but a journey that requires patience and wisdom.

In the digital age, the explosion of investment apps has reshaped the way young generations approach the financial world .

The irresistible appeal of investment apps

The appeal of investment apps lies in their ability to democratize finance. With just a smartphone and a modest amount of capital, anyone can become an investor. These apps have broken down traditional barriers such as complicated procedures, large capital requirements, and dependence on financial institutions.

Many apps allow users to start with just a few tens of thousands of dong, creating opportunities for students, new employees or people with limited idle capital to participate in the market.

Investment apps like VNDirect, TCBS, Binance or eToro have revolutionized the approach to financial markets. Users can buy and sell stocks, trade cryptocurrencies or participate in investment funds right on their phones without going through traditional intermediaries.

These apps also integrate AI technology, providing real-time market data and personalized investment suggestions, creating a sense of control and professionalism for users.

In addition, the "get rich quick" mentality and investment trends spreading on social media also contribute to the attraction. Success stories, whether real or exaggerated, on TikTok, YouTube or Telegram groups, have encouraged young people to participate.

Traps to be aware of

According to Tuoi Tre Online 's research, investment apps are also a double-edged sword, with significant potential risks that young investors need to be extremely alert to.

The risk of fraud and counterfeiting is a top concern. Many people take advantage of the lack of knowledge and the desire to get rich quickly of young people to create fake apps without operating licenses, luring users to deposit money with unrealistic promises of "huge" profits. After taking the money, these apps often disappear without a trace, causing heavy losses to investors.

In addition, the incomplete legal framework for new types of investment via apps (especially virtual currency) is also a risk. In Vietnam, many apps are still operating in a legal "gray area", making it difficult to protect investors' rights when disputes arise.

Lack of in-depth knowledge and experience is an inherent weakness of young investors. Easily caught up in crowd psychology, false rumors or price manipulation tricks, they can make emotional decisions, leading to heavy losses.

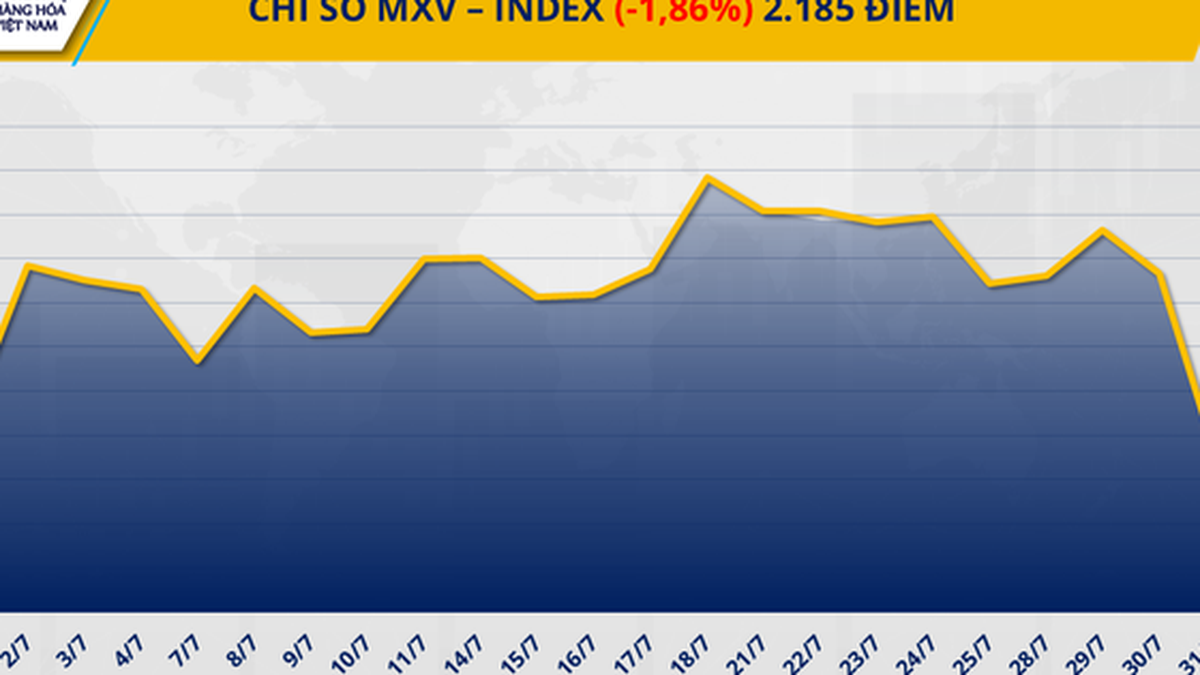

Meanwhile, market risks are always present, regardless of the investment channel. Price fluctuations, inflation, interest rates or low liquidity can all directly affect the value of investment assets.

Relying on technology is also a potential risk. Technical problems, system errors, or app security issues can disrupt transactions or even cause loss of assets.

Lack of professional advice from financial experts can also cause young investors to miss out on useful tips to optimize their portfolios.

Safety guide for young investors

To exploit investment apps safely and effectively, young investors need to equip themselves with the necessary "weapons".

First and foremost, improve your investment knowledge. Take the time to learn about financial markets, investment products, and risk management principles. Read books, take online courses, and follow reputable financial news channels. Always remember the rule: "Don't invest in something you don't understand."

Second, choose a reputable investment app. Prioritize apps that are licensed and managed by competent authorities such as the State Securities Commission. Research the parent company, read reviews from other users, and be wary of unrealistic promises of "huge" profits. A reputable app usually has a professional interface and a clear and transparent privacy policy.

Third, apply effective risk management principles. Diversify your portfolio so you don't put all your eggs in one basket. Only invest what you can afford to lose, never use borrowed money or money for essential needs. Set clear investment goals and be disciplined. Regularly monitor the market, reassess your portfolio, and be ready to adjust your strategy when necessary.

Finally, always keep your personal information secure. Use strong passwords, enable two-factor authentication (2FA), and never share your password or OTP with anyone.

"Investment apps" are a powerful tool, but also challenging

With a deep understanding of the appeal and risks, along with applying the safety manual, young investors can confidently enter the world of digital finance, turn potential into reality and build a solid financial future.

Remember, the investment journey is a marathon, not a sprint, and patience and knowledge will be your best friends.

Source: https://tuoitre.vn/suc-hut-va-rui-ro-cua-app-dau-tu-cam-nang-an-toan-cho-nha-dau-tu-tre-20250617140754067.htm

Comment (0)