Analysts are divided between bullish and neutral when forecasting gold prices next week as factors affecting the precious metal have not changed significantly.

Gold prices continued to trade steady this week as the market watched the US Federal Reserve hold interest rates steady and signal the possibility of at least one more hike this year. Rates also need to stay high for longer than previously expected.

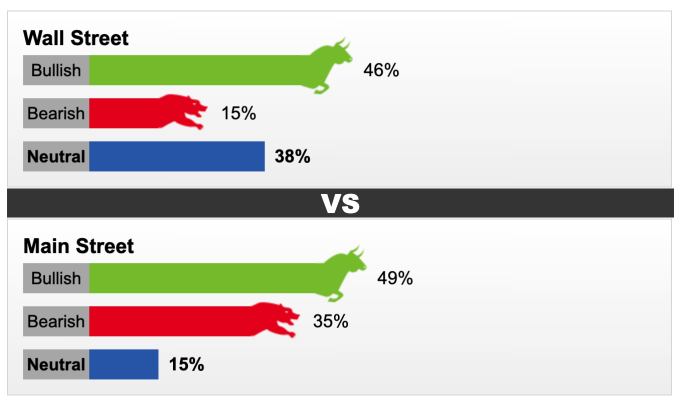

The latest Kitco News weekly gold survey shows that market analysts are split between bullish and neutral, while retail investors expect a breakout from the recent sideways price range.

Of the 13 Wall Street analysts who participated in the Kitco News gold survey, six, or 46%, see gold prices rising next week. Only two see the precious metal falling, while five, or 38%, see the market moving sideways.

As for nearly 600 individual investors who participated in the online poll, 49% of participants said that gold will increase next week, 35% predicted that the market will close the week in the red, and 15% maintained a neutral view.

Kitco News survey results forecast gold prices for the week of September 25-29. Photo: Kitco

James Stanley, senior market strategist at Forex.com, said gold could rise. “This week has been a clear uptrend, given what has happened to both Treasuries and the U.S. dollar,” Stanley said. This week’s lows were right at the resistance of the previous trendline, he said. Bulls have an opportunity to make a move next week.

Meanwhile, Colin Cieszynski, chief market strategist at SIA Wealth Management, said he is neutral on the precious metal. "Gold has been trending sideways since early September and with most of the news out, the precious metal could continue to consolidate into the end of the quarter," said SIA Wealth Management.

Gold prices remain range-bound, said Bob Haberkorn, senior broker at RJO Futures. “People are trying to interpret the message from the Fed. And that pause means rates will stay there longer than expected,” he said.

Marc Chandler, CEO at Bannockburn Global Forex, also expects gold to maintain a sideways price range.

“Gold ended the week little changed but a little firmer,” Chandler said. He said that while the precious metal had a larger trading range this week, it was generally quiet. That may reflect conflicting trends in expectations.

On a more cautious note, Ben DiCostanzo, chief market strategist at Walsh Trading, said gold is in a tough spot. Every bounce is being met with selling pressure. Gold has a lot of strong resistance ahead and the market has failed several times recently.

In the long term, he said investors remain bullish on gold, but with interest rates still high, it will be difficult for the precious metal to sustain its rally. "If we can see some movement in the US dollar, you could see a sustained rally. But as long as the greenback remains stable to some extent, I think there needs to be a break of some support to really drive gold higher."

Minh Son ( according to Kitco )

Source link

Comment (0)