After 4 days of holidays, the stock market opened the trading session on September 4 in red, VN-Index suddenly dropped sharply by 17 points, down to 1,268 points after 15 minutes of opening order matching. After that, the market recovered slightly when bottom-fishing demand appeared. However, after 11:00 a.m. on September 4, selling pressure returned, VN-Index dropped more than 13 points to 1,270 points; HNX decreased by nearly 2 points, down to 236 points; UpCoM decreased by 0.45 points, down to 93.7 points.

Foreign investors continued to net sell on the HOSE floor with a value of 460 billion VND, in which they continuously sold heavily stocks DGC, HPG, MSN... On the contrary, they collected stocks PDR, DXG, VIX...

Trading across the market remained low with over 317 million shares matched, worth less than VND7,500 billion. All three exchanges had 189 stocks increasing in price, 584 stocks decreasing, of which 11 stocks hit the floor and 11 stocks hit the ceiling.

According to experts, the market's plunge this morning is not too surprising.

Industry fluctuations in this morning session

A consultant from VPS Securities Company assessed that the market opened with a strong correction on September 4 due to the impact of the US stock market falling more than 600 points. This caused many investors to be psychologically affected, leading to short-term profit-taking. However, whether the market is green or red is no longer something that investors are too concerned about because the industries have been quite differentiated. What is important is that investors are holding investment portfolios and industry codes to make effective profits.

"Many industries decreased slightly in the early session this morning but then recovered near the reference price. The market is at the resistance zone at 1,290 - 1,300 points. There is a high possibility that this threshold will be exceeded in September and October," the expert predicted.

US stocks and other markets plummeted.

An investment expert said the market's decline this morning was partly due to the impact of US stocks and other markets all falling, while domestic macro factors remained good. Therefore, this will be an opportunity for investors to consider buying some potential stocks in the public investment sector.

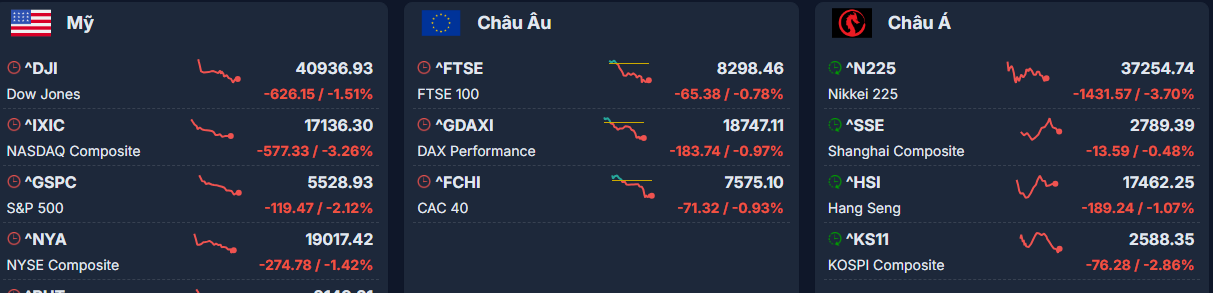

Last night, the US stock market recorded its worst trading day since the global sell-off on August 5. Closing the session on September 3, the Dow Jones index fell more than 626 points (-1.51%) to 40,936 points; the S&P 500 fell 119 points (-2.12%) to 5,528 points and the Nasdaq Composite fell 577 points (-3.26%) to 17,136 points.

Following the US market, the Asia- Pacific market also "turned red" this morning when Japan's Nikkei 225 fell 3.19%, leading the decline in the region. Meanwhile, the Topix also fell 2.79%.

South Korea's Kospi and Kosdaq also fell 2.17% and nearly 3%, respectively; Australia's S&P/ASX 200 fell nearly 1.7%, mainly due to weak oil prices; Hong Kong's Hang Seng fell 1.5%, and mainland China's CSI 300 fell 0.47%.

Source: https://nld.com.vn/vi-sao-chung-khoan-rot-manh-sau-ky-nghi-le-196240904105652868.htm

Comment (0)