Cashless payments accelerate

According to information from the State Bank, in the first half of 2025 alone, the total number of cashless payment transactions exceeded 12 billion transactions, higher than the total transactions in the whole year of 2023 and approaching the record of 17.7 billion transactions in 2024. This acceleration shows that the trend of cashless payments is increasingly penetrating deeply into economic and social life.

Mr. Pham Anh Tuan, Director of the Payment Department, State Bank of Vietnam, commented: “Cashless payment transactions are growing impressively, increasing by an average of 30 to 40% per year. Vietnam's average transaction per capita has approached that of Thailand and India and is second only to China. The total value of cashless transactions in 2024 will reach VND295.2 trillion, about 26 times higher than Vietnam's GDP."

According to Dr. Nguyen Quoc Hung, Vice Chairman and General Secretary of the Vietnam Banking Association, the Law on Value Added Tax 2024 officially takes effect from July 1, 2025, clearly stipulating that except for some special cases, all purchased goods and services regardless of value can only be deducted for input value added tax if there is a non-cash payment document.

“This regulation is directly promoting cashless payments, while supporting the development of the banking system, enhancing transparency in financial management, supporting e-commerce, public services and reducing social costs,” Dr. Nguyen Quoc Hung emphasized.

In addition, the State Bank is also implementing many measures to "clean up" the bank account system. As of July 4, 2025, more than 120.9 million individual customer records and more than 1.2 million corporate customer records have been compared with biometric information. Accounts that have not generated transactions for a long time will be reviewed and eliminated. The State Bank has built a database of accounts suspected of fraud and required banks to proactively block accounts showing signs of abnormality, in order to prevent high-tech crimes and financial fraud in the digital environment.

According to a representative of the State Bank, after a period of cleaning the customer database and applying biometric information matching solutions, compared to the same period in 2024, the number of individual customers who were scammed and lost money decreased by about 57%, and the number of individual accounts receiving scammed money decreased by about 47%.

Comprehensive digital transformation

Recently, Deputy Prime Minister Ho Duc Phoc signed Official Dispatch No. 124/CD-TTg of the Prime Minister, sent to ministries, branches and localities, on promoting non-cash payments.

The dispatch clearly stated that, although the Government and the Prime Minister have had many drastic, timely and effective instructions, cash payment activities still show signs of increasing, causing waste of resources and posing a potential risk of being exploited for tax evasion, money laundering and illegal activities.

To continue developing non-cash payments, the Prime Minister requested ministries, ministerial-level agencies, government agencies, and People's Committees of provinces and cities to continue promoting the development of non-cash payments, ensuring that they meet the payment needs of people and businesses, saving resources, preventing tax losses and crimes; and strictly handling violations of the law.

Regarding the State Bank, the Prime Minister directed this agency to strengthen inspection, examination, supervision, and anti-money laundering in banking activities; promptly warn, detect, and strictly handle violations of the law, money laundering, and illegal payments; continue to strengthen the development of payment infrastructure and technology to promote non-cash payments. At the same time, he directed credit institutions to urgently continue to develop and provide products and services to promote non-cash payments...

In fact, commercial banks have many solutions to promote cashless payments among each customer group.

Standing out with the "Super payment solution" ecosystem, Vietnam Prosperity Joint Stock Commercial Bank ( VPBank ) integrates a series of payment support tools such as Pay by Account, Tap to Phone, Bion account, Thinh Vuong Shop, Soundbox speaker... allowing consumers and businesses to transact seamlessly on the VPBank NEO digital banking platform. Users can open accounts, create QR codes, accept card payments right on their phones, receive audio balance alerts, process electronic invoices... Each operation is intuitively designed and comes with incentives such as cashback, free beautiful account numbers, e-voucher gifts...

Similarly, Saigon - Hanoi Commercial Joint Stock Bank (SHB ) developed a new generation digital bank SHB SAHA, fully integrating financial services, from basic transactions to insurance, investment, and loans on a single interface. In addition, SHB also supports identification of ETC non-stop toll collection accounts and linking VETC traffic wallets via a digital platform. The process of identification, account opening, and wallet linking is shortened to one step.

Meanwhile, Vietnam Maritime Commercial Joint Stock Bank (MSB) chose a strategy of deep personalization of experience, investing more than 4.3 million USD in a technology platform that helps collect, analyze and respond to customer needs in real time, thereby implementing personalized marketing campaigns according to each behavior and stage. The results showed that the number of new online credit cards increased by 186%, digital transactions increased by 40% and the number of customer feedback reached more than 80,000. MSB also aims to use more artificial intelligence (AI) and machine learning (Machine Learning) to automate the entire customer interaction process, improving efficiency and emotions in the financial experience.

Sharing about the effectiveness of digital transformation, Mr. Nguyen Viet Anh, Deputy General Director of Tien Phong Commercial Joint Stock Bank ( TPBank ) said that the application of digital transformation processes has helped the bank reduce at least 20% of human operations, reducing unnecessary steps. But more importantly, it helps customers save time, reduce waiting steps, and travel back and forth to provide documents or information.

2025 is the time to summarize the Project on developing non-cash payments for the period 2021 - 2025. With the coordination of management agencies, credit institutions and people, promoting non-cash payments is no longer a distant concept but is becoming an essential part of the transition to a digital economy.

Source: https://doanhnghiepvn.vn/kinh-te/ngan-hang-tang-toc-so-hoa-day-manh-thanh-toan-khong-tien-mat/20250808071540485

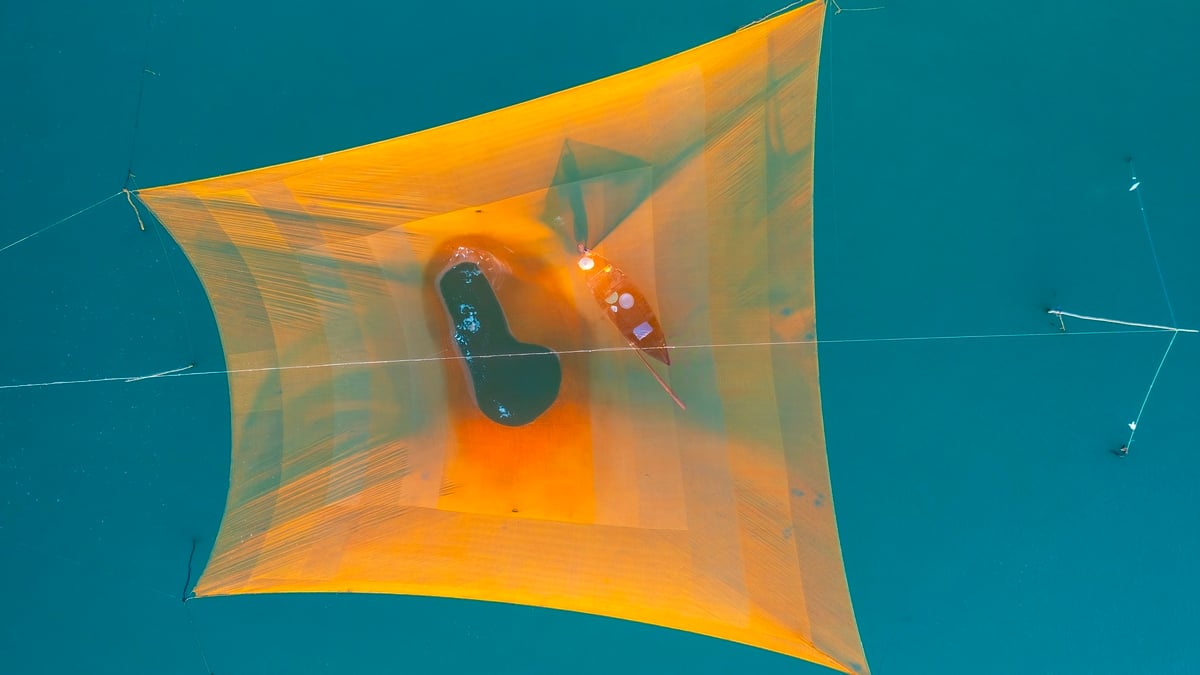

![[Photo] Discover the "wonder" under the sea of Gia Lai](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/6/befd4a58bb1245419e86ebe353525f97)

Comment (0)