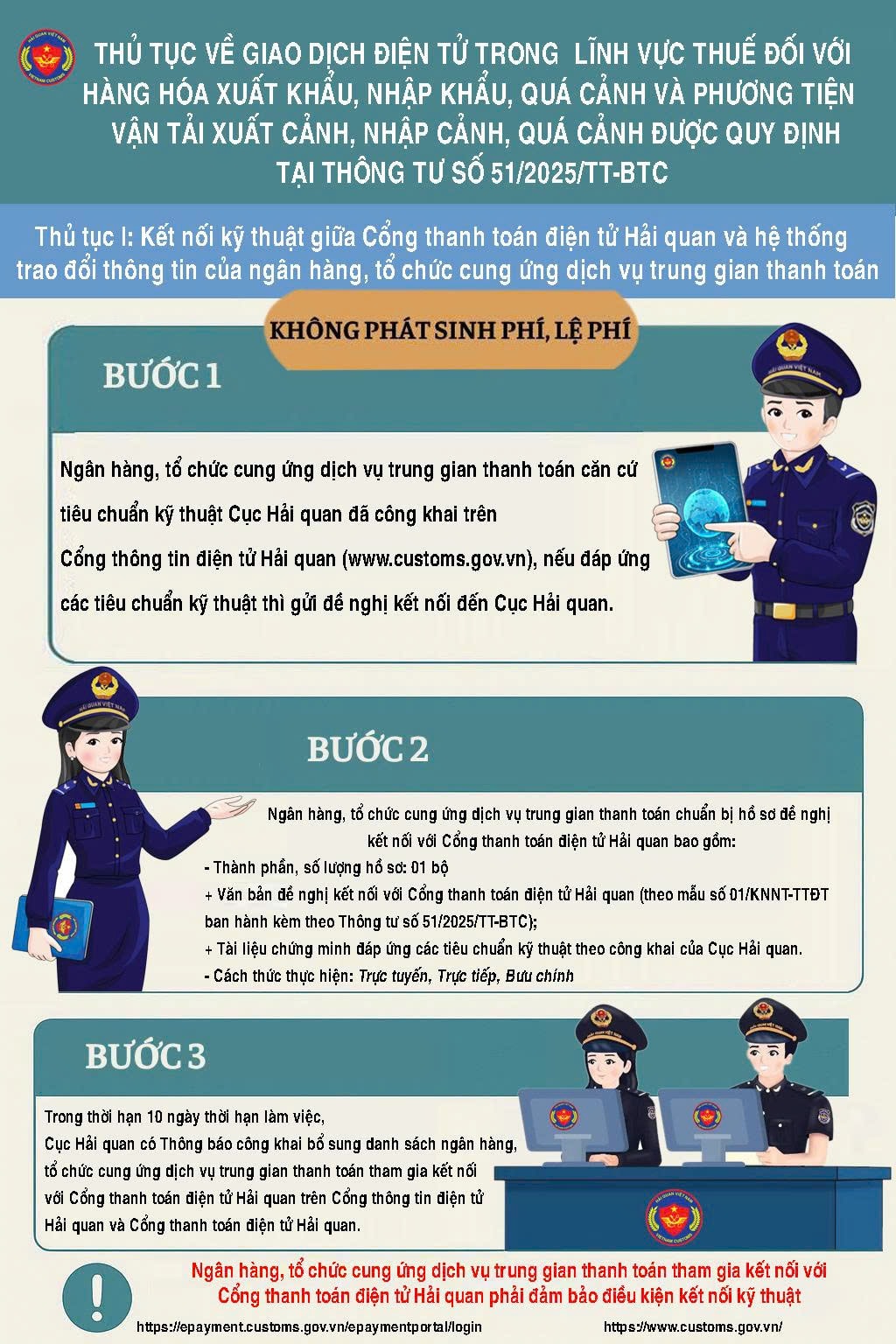

The Ministry of Finance has just issued Circular No. 51/2025/TT-BTC regulating electronic transactions in the field of tax for exported, imported, and transit goods and means of exit, entry, and transit, effective from August 7, 2025.

According to the Customs Department, this is an important step to promote the application of information technology and digital transformation in tax and customs management, contributing to reforming administrative procedures and creating convenience for people, businesses and state management agencies.

One of the notable points is the pilot of electronic tax collection and payment through an intermediary payment service provider. This solution brings many conveniences, increases options for taxpayers, and contributes to the implementation of the non-cash payment project under the direction of the Prime Minister .

Circular 51/2025/TT-BTC also creates a legal basis to further expand electronic tax collection and payment through intermediary payment service providers, allowing customs authorities to use state budget payment information transferred by intermediary organizations to the Customs Electronic Payment Portal to account for, deduct debts and confirm completion of tax obligations.

Taxpayers can conduct electronic transactions in the tax field through many payment channels suitable to their needs, through bank applications, applications of payment intermediary service providers or online on the customs electronic transaction portal.

Taxpayers can fulfill their tax obligations, be notified of arising tax obligations, creating maximum convenience for paying taxes and fees anytime, anywhere, with any internet connection.

Customs authorities increase convenience and cashless payment services; shorten administrative procedures and processes.

Source: https://hanoimoi.vn/thi-diem-thu-nop-thue-dien-tu-qua-to-chuc-cung-ung-dich-vu-711683.html

![[Photo] Nghe An: Provincial Road 543D seriously eroded due to floods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/5/5759d3837c26428799f6d929fa274493)

![[Photo] Discover the "wonder" under the sea of Gia Lai](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/6/befd4a58bb1245419e86ebe353525f97)

Comment (0)