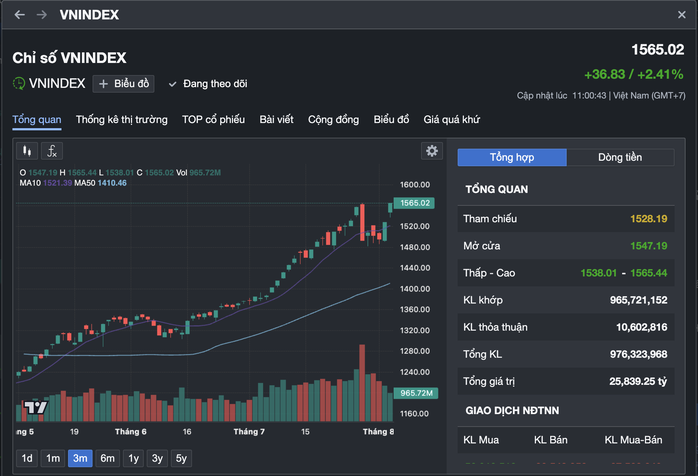

Stocks surpass historical peak

On the morning of August 5, the stock market continued to explode with widespread green, pushing the VN-Index up more than 40 points to 1,569 points, surpassing the record of 1,564 points set on July 29. Notably, the VN30 index - representing large-cap stocks - surpassed the 1,700-point mark for the first time, increasing by 58 points, setting a new record in the history of this index.

Cash flow in the market continues to improve significantly. Although the morning session has not ended, HoSE has already had more than 1 billion shares transferred, matching orders of more than 28,000 billion VND.

Abundant liquidity shows that investor sentiment is very positive, especially when many large stocks increased in price. Vingroup group with VIC and VHM broke out strongly, while banking codes such as TCB, MBB, VCB, BID, CTG also played a leading role, creating significant momentum for the general market's growth.

Can I invest in stocks with 10 million VND?

The positive developments of the market are attracting the attention of a large number of new investors. Many of them have only 10-20 million VND in hand but still want to participate in the market to seek profit opportunities. Ms. Khanh Nga, an F0 investor in Ho Chi Minh City, shared that she has just opened a securities trading account with 10 million VND in idle money. However, she is still wondering whether she should invest with such a small amount of capital, and if so, how to avoid losses in the context of a hot market.

Responding to this issue, financial expert Phan Dung Khanh said that with current regulations, you only need to own a minimum lot of 10 shares to be able to start participating in the market. If the stock is priced at 10,000 VND, investors only need about 1 million VND to buy 100 shares. Thus, with an amount of 2 to 10 million VND, it is completely possible to choose stocks with reasonable prices to invest.

Currently, the stock prices of some large enterprises are still quite “soft” and suitable for small-capital investors. For example, 100 BID shares cost about 3.89 million VND;ACB is 2.37 million VND; HPG is 2.63 million VND; SSI is 3.42 million VND. These are all stocks with high liquidity and relatively good transparency, suitable for beginners.

However, Mr. Khanh also noted that with small capital, investors are easily limited in their portfolios and find it difficult to diversify to reduce risks. During periods of strong market growth, newcomers often fall into the mentality of wanting to "make quick profits", leading to widespread investment, choosing stocks based on trends without carefully considering fundamental factors. Therefore, the important thing for F0 investors is not large or small capital, but knowledge, patience and a clear investment strategy from the beginning.

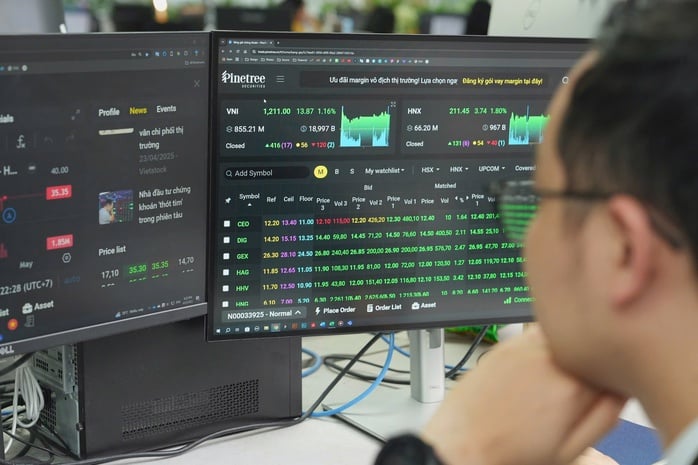

The stock market has been continuously rising recently, attracting the participation of many new investors.

"They can use financial leverage (margin), borrow to invest in the hope of increasing profits quickly. In many cases, this helps them double their accounts in a short time, but it can also easily lead to loss of control. Therefore, investors with small capital need to be especially careful. A strong "wave" of the market can wipe out all the investment money if there is no risk prevention strategy" - Mr. Phan Dung Khanh said.

On the other hand, small investors still have certain advantages over large investors. Because of their small capital, they are more flexible and can buy low-priced, low-liquidity stocks - stocks that large investors find difficult to participate in because the large transaction size can affect the price.

What small investors need to keep in mind is to understand their strengths and weaknesses. If using leverage, the amount borrowed should not exceed 50% of the actual capital, to ensure the ability to control risks. Always set a defense threshold for the investment account.

Stock selection method when investing in stocks with 10 million VND

Mr. Tran Hoang Son, Director of Market Strategy, VPBank Securities Company, cited Mr. Dan Zanger as a legendary investor who turned 18,000 USD into 42 million USD in 24 months. His experience is to focus on growing businesses.

He often selects the top 50 companies on the stock exchange with good profit growth rates, which are in the stock portfolios that most investors are interested in. The method Mr. Zanger uses is CANSLIM - a method of filtering good stocks, finding reasonable prices for investment; technical analysis and cash flow.

"In a rising wave like the current VN-Index, investors can choose stocks with a solid foundation, benefiting from cyclical factors and high growth. These are "golden" stocks. After choosing the golden time and choosing the right way to disburse into golden stocks, in the medium and long term, assets will increase" - Mr. Tran Hoang Son said.

VN-Index is reaching its historical peak

Source: https://nld.com.vn/chung-khoan-vuot-dinh-lich-su-10-trieu-dong-co-mua-duoc-co-phieu-196250805110529234.htm

Comment (0)