Domestic gold price today August 6, 2025

As of 4:00 a.m. today, August 6, 2025, the domestic gold bar price increased sharply, close to a record high. Specifically:

DOJI Group listed the price of SJC gold bars at 122.2-123.8 million VND/tael (buy - sell), an increase of 500 thousand VND/tael in both buying and selling directions compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 122.2-123.8 million VND/tael (buy - sell), an increase of 500 thousand VND/tael in both buying and selling directions compared to the closing price on August 4 yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 122.6-123.8 million VND/tael for buying and selling. Compared to yesterday, the gold price increased by 400 thousand VND/tael for buying and 600 thousand VND/tael for selling.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 122.2-123.8 million VND/tael (buy - sell), the price increased by 500 thousand VND/tael in both buying and selling directions compared to the same period yesterday.

SJC gold price at Phu Quy is traded by businesses at 121.2-123.8 million VND/tael (buy - sell), gold price increased by 700 thousand VND/tael in buying direction - increased by 500 thousand VND/tael in selling direction compared to yesterday.

As of 4:00 a.m. on August 6, 2025, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 117.5-120 million VND/tael (buy - sell); the price increased by 500 thousand VND/tael in both buying and selling directions compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 117.8-120.8 million VND/tael (buy - sell); an increase of 600 thousand VND/tael in both buying and selling directions compared to yesterday.

The latest gold price list today, August 6, 2025 is as follows:

| Gold price today | August 6, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 122.2 | 123.8 | +500 | +500 |

| DOJI Group | 122.2 | 123.8 | +500 | +500 |

| Red Eyelashes | 122.6 | 123.8 | +400 | +600 |

| PNJ | 122.2 | 123.8 | +500 | +500 |

| Bao Tin Minh Chau | 122.2 | 123.8 | +500 | +500 |

| Phu Quy | 121.2 | 123.8 | +700 | +500 |

| 1. DOJI - Updated: August 6, 2025 04:00 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 122,200 ▲500K | 123,800 ▲500K |

| AVPL/SJC HCM | 122,200 ▲500K | 123,800 ▲500K |

| AVPL/SJC DN | 122,200 ▲500K | 123,800 ▲500K |

| Raw material 9999 - HN | 110,000 ▲500K | 111,000 ▲500K |

| Raw material 999 - HN | 109,900 ▲500K | 110,900 ▲500K |

| 2. PNJ - Updated: August 6, 2025 04:00 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| SJC 999.9 gold bar | 122,200 | 123,800 |

| PNJ 999.9 Plain Ring | 117,500 | 120,000 |

| Kim Bao Gold 999.9 | 117,500 | 120,000 |

| Gold Phuc Loc Tai 999.9 | 117,500 | 120,000 |

| PNJ Gold - Phoenix | 117,500 | 120,000 |

| 999.9 gold jewelry | 116,300 | 118,800 |

| 999 gold jewelry | 116,180 | 118,680 |

| 9920 jewelry gold | 115,450 | 117,950 |

| 99 gold jewelry | 115,210 | 117,710 |

| 916 Gold (22K) | 106,420 | 108,920 |

| 750 Gold (18K) | 81,750 | 89,250 |

| 680 Gold (16.3K) | 73,430 | 80,930 |

| 650 Gold (15.6K) | 69,870 | 77,370 |

| 610 Gold (14.6K) | 65,120 | 72,620 |

| 585 Gold (14K) | 62,150 | 69,650 |

| 416 Gold (10K) | 42,070 | 49,570 |

| 375 Gold (9K) | 37,200 | 44,700 |

| 333 Gold (8K) | 31,850 | 39,350 |

| 3. SJC - Updated: 8/6/2025 04:00 - Source website time - ▲/▼ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 122,200 ▲500K | 123,800 ▲500K |

| SJC gold 5 chi | 122,200 ▲500K | 123,820 ▲500K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 122,200 ▲500K | 123,830 ▲500K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 116,800 ▲500K | 119,300 ▲500K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 116,800 ▲500K | 119,400 ▲500K |

| Jewelry 99.99% | 116,800 ▲500K | 118,700 ▲500K |

| Jewelry 99% | 113,024 ▲495K | 117,524 ▲495K |

| Jewelry 68% | 73,974 ▲340K | 80,874 ▲340K |

| Jewelry 41.7% | 42,752 ▲208K | 49,652 ▲208K |

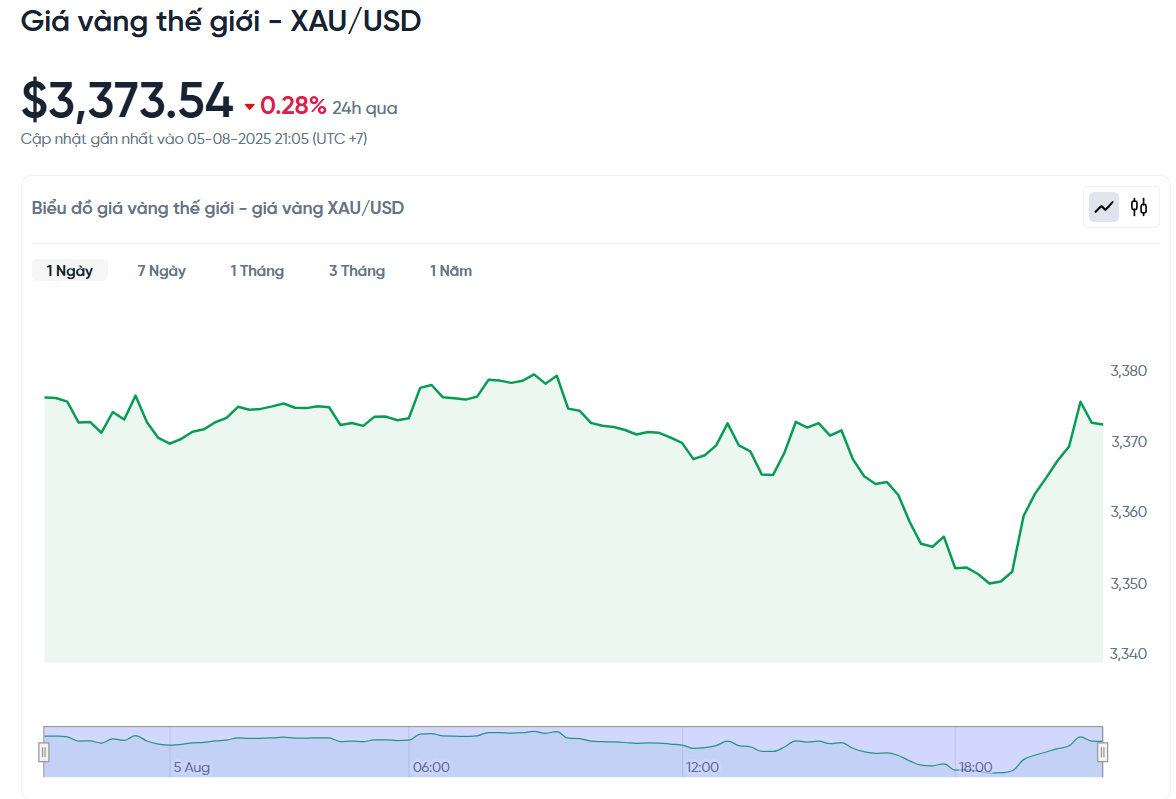

World gold price today August 6, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:00 a.m. on August 6, Vietnam time, was 3,373.54 USD/ounce. Today's gold price decreased by 9.59 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,390 VND/USD), the world gold price is about 110.77 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 13.03 million VND/tael higher than the international gold price.

World gold prices fell slightly as the stronger US dollar somewhat reduced the upward pressure from expectations that the US Federal Reserve (Fed) will cut interest rates. The market is also waiting for President Trump's announcement on appointing new personnel to the Fed.

Specifically, spot gold prices fell slightly by 0.28%, after hitting their highest level since July 24 the previous day. US gold futures also rose by 0.1% to $3,430.

The dollar rose 0.2%, making gold more expensive for foreign investors. Bob Haberkorn, chief market strategist at RJO Futures, said that while the strong dollar is weighing on gold, expectations that the Fed will start cutting interest rates in September are still a positive factor.

The market now expects the Fed to cut interest rates twice this year, starting in September after a weaker-than-expected June jobs report. Gold is often seen as a safe haven during times of political or economic uncertainty, and it benefits from low interest rates because it does not pay interest.

In another development, President Trump said he will soon announce a decision on an interim replacement for Fed member Adriana Kugler, who recently resigned, along with a nomination for the next Fed Chair.

U.S. trade data for June showed the deficit narrowed as imports of consumer goods fell sharply, reflecting the impact of Trump’s tariffs. Investors are looking to Thursday’s U.S. jobs report for further clues on the Fed’s interest rate path.

China's services sector unexpectedly expanded in July, hitting its fastest pace in more than a year. The S&P services PMI rose to 52.6 from 50.6, the highest since May 2024. The result beat the median forecast of economists surveyed by Bloomberg. Summer is typically a peak season for services such as tourism, transportation and entertainment.

Besides gold, spot silver prices rose 0.4% to $37.53 an ounce, the highest since July 30. Platinum prices fell 1.3% to $1,312.42 and palladium lost 1.7% to $1,186.18.

Gold Price Forecast

On the afternoon of August 5, at the headquarters of Saigon Jewelry Company (SJC) (HCMC), the number of customers coming to trade plain gold rings and gold bars was still very large. Many people were worried about the fluctuations of the market and chose to buy gold as a way to preserve their assets.

Mr. Dang Van Huy, a customer living in Khanh Hoi ward, shared: "I decided to buy gold now because I am afraid that the price will continue to increase in the near future. For me, gold is always the safest place to put money."

In the same mood, Ms. Tran Thi Huyen (Xuan Hoa ward) said she waited nearly an hour to make a transaction. "I intended to buy 1.5 taels but the store only sold 1 tael per person. The price of gold has been fluctuating recently, so I took the opportunity to buy now before the price increases further," Ms. Huyen said.

According to the World Gold Council, gold prices are likely to increase sharply in the context of the complicated geopolitical and economic situation in the world. If inflation accompanied by economic recession (stagflation) becomes more evident, many investors will flock to gold as a safe haven.

However, if global trade stabilizes and recovers, yields could rise, making investors more risk-averse and reducing the appeal of gold. Additionally, if central banks reduce their purchases of gold, this would also put downward pressure on the market.

Citigroup recently revised its gold price forecast to $3,500 an ounce in the next three months, much higher than its June forecast. The reason is concerns about the US economic slowdown, inflation due to tariffs, a weakening US dollar and geopolitical tensions.

Citi also expanded its gold price forecast to $3,300 to $3,600 an ounce. The bank said gold demand has increased more than 33% since mid-2022, driven by investment inflows, central bank purchases and solid jewelry demand. This is a significant change from its bearish forecast six weeks ago.

Although gold has been on an upward trend, the strong recovery of the US stock market has somewhat reduced the increase of this precious metal. Closing the session on August 4, the Dow Jones index increased by 585.06 points (1.34%) to 44,173.64 points, completely offsetting the sharp decline from the previous session.

Source: https://baonghean.vn/gia-vang-hom-nay-6-8-gia-vang-trong-nuoc-va-the-gioi-cao-ky-luc-nguoi-dan-sot-sang-mua-vang-10303906.html

![[Photo] Nghe An: Provincial Road 543D seriously eroded due to floods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/5/5759d3837c26428799f6d929fa274493)

Comment (0)