Proposal to adjust family deductions: Prioritize options linked to GDP and income

Why not choose zoning when calculating family deductions?

Speaking at the regular Government press conference in July held by the Government Office on the afternoon of August 7 in Hanoi, Deputy Minister of Finance Nguyen Duc Chi said: In the process of developing the proposal to adjust the family deduction level when calculating personal income tax, the Ministry of Finance has received many comments from experts, professional staff as well as relevant agencies. This is important content, because the family deduction level has a direct impact on the amount of tax payable by employees, especially in the context of increasing living costs.

One of the proposals that has been raised is to calculate the family deduction based on geographical area – specifically, applying a higher rate to cities with high living costs such as Hanoi or Ho Chi Minh City. However, after careful research, the Ministry of Finance assessed that this option is difficult to implement in terms of organization and administrative management.

In fact, not only between provinces but also within the same city, there is a big difference in the cost of living. For example, in Ho Chi Minh City, a resident living in the central district will have to face a significantly higher spending level than a resident in the suburban districts. The same situation also occurs in Hanoi - where there are communes and districts in rural areas, with lower prices than the center.

Therefore, if the family deduction is applied by region, it will create more complicated classification criteria, which can easily cause inconsistencies and inconsistencies. Tax management by ward, commune, district is very difficult to implement in practice.

Deputy Minister of Finance Nguyen Duc Chi shares information at a press conference - Photo: VGP/Nhat Bac

Prioritize the calculation method based on income growth rate and GDP per capita growth rate.

The Ministry of Finance has proposed two options for adjusting the family deduction level to solicit public opinion. The first option is to continue basing the adjustment level on the current consumer price index (CPI). The second option is to adjust according to the growth rate of per capita income and per capita GDP growth rate.

According to the Ministry of Finance, both options have certain advantages and limitations. However, after synthesizing comments, the majority of experts agree with the second option. Adjusting according to average income and GDP is considered more realistic, clearly reflecting people's ability to pay and living standards over time.

The Ministry of Finance is currently updating and completing accurate data on income and GDP growth rates from 2020 to present. On that basis, the Ministry will determine specific adjustment levels and report to the Government, submit to the National Assembly Standing Committee in accordance with the order of drafting and promulgating legal documents.

Huy Thang

Source: https://baochinhphu.vn/dieu-chinh-giam-tru-gia-canh-uu-tien-phuong-an-gan-voi-gdp-va-thu-nhap-102250807164630054.htm

![[Photo] Nghe An: Provincial Road 543D seriously eroded due to floods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/5/5759d3837c26428799f6d929fa274493)

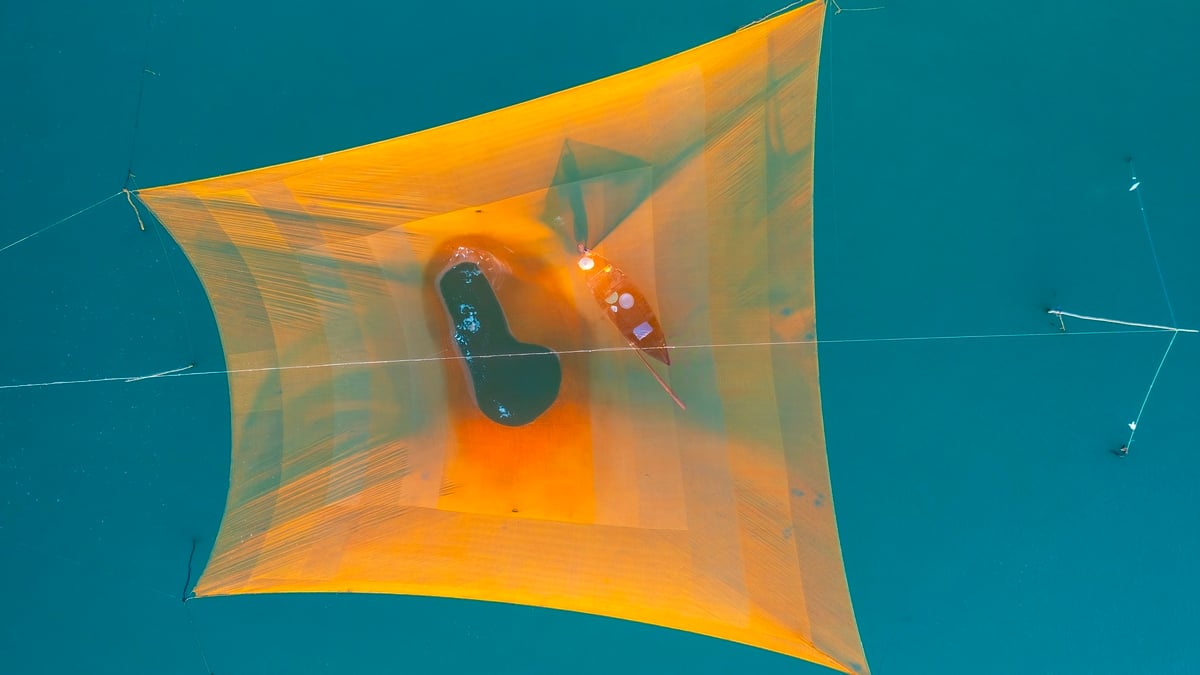

![[Photo] Discover the "wonder" under the sea of Gia Lai](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/6/befd4a58bb1245419e86ebe353525f97)

Comment (0)