At the regular Government press conference on August 7, Deputy Minister of Finance Nguyen Duc Chi said that when drafting the Law on Personal Income Tax (replacement), experts and professional staff proposed many different options to determine the family deduction level, including calculation by region and area.

This method was included in the draft by the Ministry of Finance in March, in which the regional minimum wage is a reference basis for determining family deductions.

However, he said that if the family deduction is divided by region, it will be very difficult to implement. Because even within a province or city, each area has different living expenses and requirements for family deductions. "Even in Ho Chi Minh City or Hanoi , the cost of living in the central area is very high, but the communes in the countryside are different," he said.

Therefore, in the latest draft, the Ministry of Finance proposed two options for calculating family deductions, including basing on the current CPI or the growth rate of average income per capita.

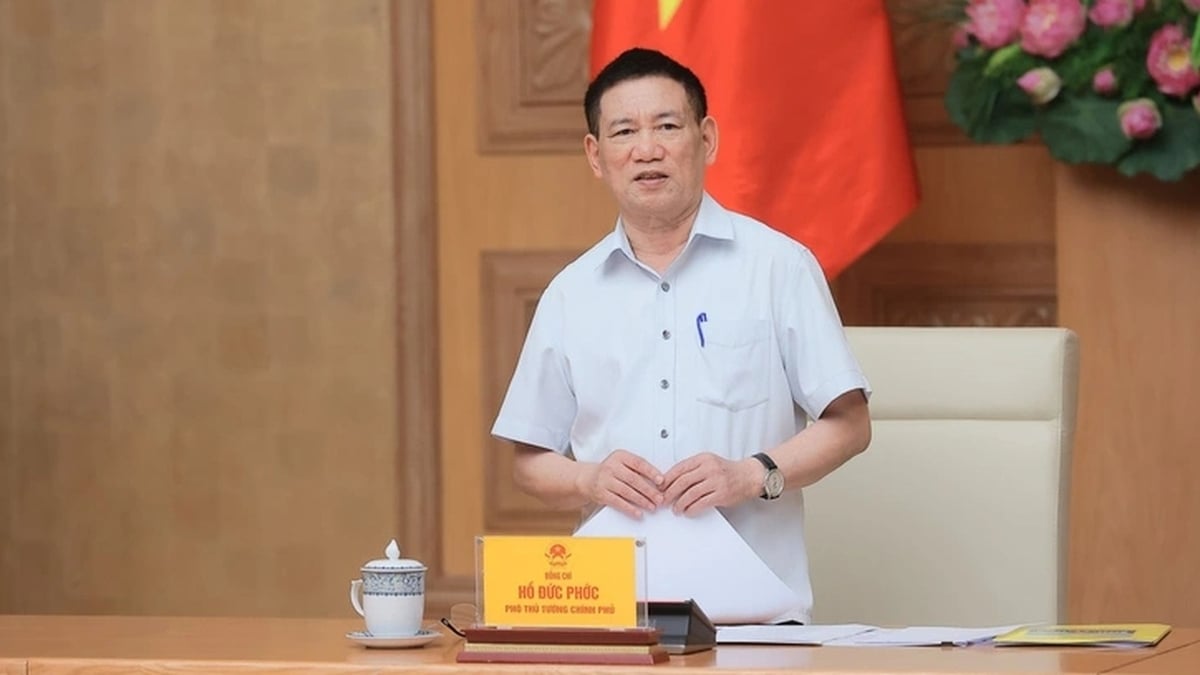

Deputy Minister of Finance Nguyen Duc Chi informed about the proposal to increase the family deduction level in the draft Law on Personal Income Tax (Photo: VGP).

Mr. Chi said that after a period of public consultation, the majority of comments "agreed with option 2", which is to calculate family deductions based on average income per capita. According to this option, the deduction for taxpayers is expected to be 15.5 million VND, and for dependents, 6.2 million VND per month.

Deputy Minister Chi said that the agency will complete the draft and have a plan to report to the Government and the National Assembly. It is expected that the Personal Income Tax Law (replacement) will be submitted to the National Assembly at the session in October.

The Law will amend and supplement regulations related to deduction levels when calculating personal income tax. Adjust and reduce the number of tax brackets of the progressive tax schedule applicable to resident individuals with income from salaries and wages.

At the same time, review, amend and supplement regulations on tax calculation period, tax deduction, time to determine taxable income; amend and supplement regulations on responsibilities of organizations and individuals paying income and responsibilities of taxpayers...

According to current regulations, the family deduction for individual taxpayers is 11 million VND and the deduction for each dependent is 4.4 million VND, maintained from July 2020. Individuals are deducted for insurance, family deductions, allowances, subsidies..., the remaining amount is the income used to calculate personal income tax.

However, this deduction is considered by most experts to be inappropriate in calculating personal income tax, when spending and living are increasingly expensive.

Personal income tax is the third highest source of revenue in the tax system, after value added tax (VAT) and corporate income tax.

In 2024, total state budget revenue will exceed VND2 million billion for the first time. Of which, personal income tax is estimated at VND189,000 billion, up 20% over the previous year.

Source: https://dantri.com.vn/kinh-doanh/khong-nang-giam-tru-gia-canh-voi-ha-noi-tphcm-do-kho-trien-khai-20250807172101256.htm

![[Photo] Discover the "wonder" under the sea of Gia Lai](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/6/befd4a58bb1245419e86ebe353525f97)

![[Photo] Nghe An: Provincial Road 543D seriously eroded due to floods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/5/5759d3837c26428799f6d929fa274493)

Comment (0)